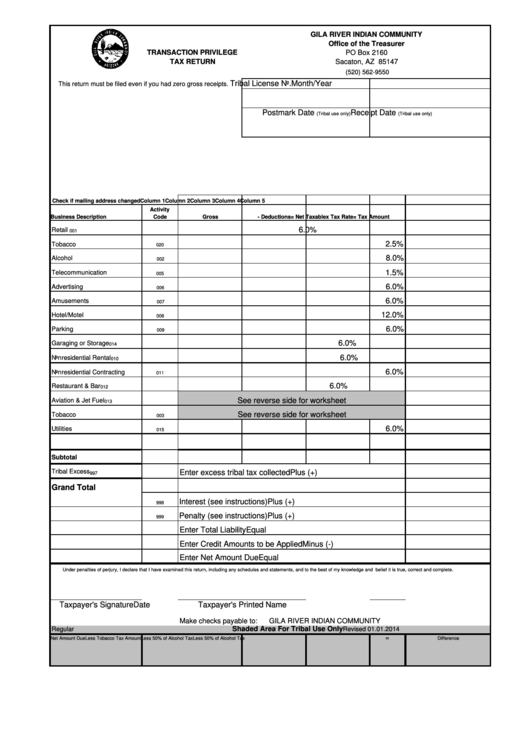

Transaction Privilege Tax Return Form

ADVERTISEMENT

GILA RIVER INDIAN COMMUNITY

Office of the Treasurer

TRANSACTION PRIVILEGE

PO Box 2160

TAX RETURN

Sacaton, AZ 85147

(520) 562-9550

Tribal License No.

Month/Year

This return must be filed even if you had zero gross receipts.

Postmark Date

Receipt Date

(Tribal use only)

(Tribal use only)

Check if mailing address changed

Column 1

Column 2

Column 3

Column 4

Column 5

Activity

Business Description

Code

Gross

- Deductions

= Net Taxable

x Tax Rate

= Tax Amount

6.0%

Retail

001

2.5%

Tobacco

020

8.0%

Alcohol

002

1.5%

Telecommunication

005

6.0%

Advertising

006

6.0%

Amusements

007

12.0%

Hotel/Motel

008

6.0%

Parking

009

6.0%

Garaging or Storage

014

6.0%

Nonresidential Rental

010

6.0%

Nonresidential Contracting

011

6.0%

Restaurant & Bar

012

See reverse side for worksheet

Aviation & Jet Fuel

013

See reverse side for worksheet

Tobacco

003

6.0%

Utilities

015

Subtotal

Tribal Excess

Enter excess tribal tax collected

Plus (+)

997

Grand Total

Interest (see instructions)

Plus (+)

998

Penalty (see instructions)

Plus (+)

999

Enter Total Liability

Equal

Enter Credit Amounts to be Applied

Minus (-)

Enter Net Amount Due

Equal

Under penalties of perjury, I declare that I have examined this return, including any schedules and statements, and to the best of my knowledge and belief it is true, correct and complete.

Taxpayer's Signature

Taxpayer's Printed Name

Date

Make checks payable to:

GILA RIVER INDIAN COMMUNITY

Shaded Area For Tribal Use Only

Regular

Revised 01.01.2014

=

Net Amount Due

Less Tobacco Tax Amount

Less 50% of Alcohol Tax

Less 50% of Alcohol Tax

Difference

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2