Reset

Print

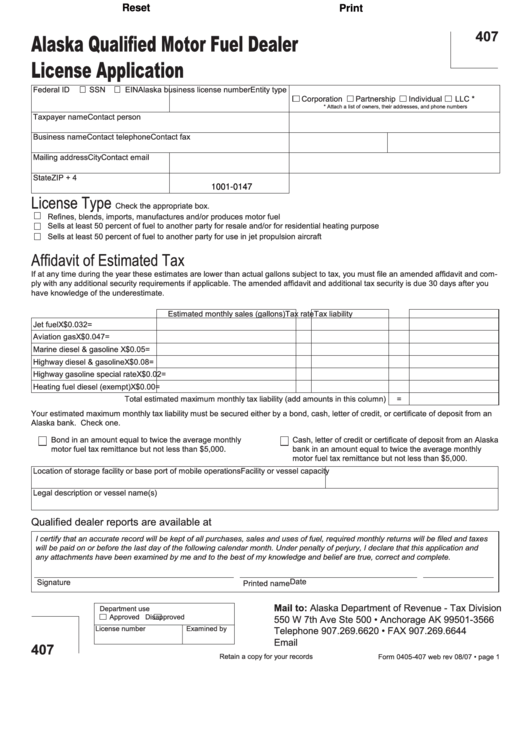

407

Alaska Qualified Motor Fuel Dealer

License Application

Federal ID

SSN

EIN

Alaska business license number

Entity type

Corporation

Partnership

Individual

LLC *

* Attach a list of owners, their addresses, and phone numbers

Taxpayer name

Contact person

Business name

Contact telephone

Contact fax

Mailing address

City

Contact email

State

ZIP + 4

1001-0147

License Type

Check the appropriate box.

Refines, blends, imports, manufactures and/or produces motor fuel

Sells at least 50 percent of fuel to another party for resale and/or for residential heating purpose

Sells at least 50 percent of fuel to another party for use in jet propulsion aircraft

Affidavit of Estimated Tax

If at any time during the year these estimates are lower than actual gallons subject to tax, you must file an amended affidavit and com-

ply with any additional security requirements if applicable. The amended affidavit and additional tax security is due 30 days after you

have knowledge of the underestimate.

Estimated monthly sales (gallons)

Tax rate

Tax liability

Jet fuel

X

$0.032

=

Aviation gas

X

$0.047

=

Marine diesel & gasoline

X

$0.05

=

Highway diesel & gasoline

X

$0.08

=

Highway gasoline special rate

X

$0.02

=

Heating fuel diesel (exempt)

X

$0.00

=

Total estimated maximum monthly tax liability (add amounts in this column)

=

Your estimated maximum monthly tax liability must be secured either by a bond, cash, letter of credit, or certificate of deposit from an

Alaska bank. Check one.

Bond in an amount equal to twice the average monthly

Cash, letter of credit or certificate of deposit from an Alaska

motor fuel tax remittance but not less than $5,000.

bank in an amount equal to twice the average monthly

motor fuel tax remittance but not less than $5,000.

Location of storage facility or base port of mobile operations

Facility or vessel capacity

Legal description or vessel name(s)

Qualified dealer reports are available at

I certify that an accurate record will be kept of all purchases, sales and uses of fuel, required monthly returns will be filed and taxes

will be paid on or before the last day of the following calendar month. Under penalty of perjury, I declare that this application and

any attachments have been examined by me and to the best of my knowledge and belief are true, correct and complete.

Date

Signature

Printed name

Mail to: Alaska Department of Revenue - Tax Division

Department use

Approved

Disapproved

550 W 7th Ave Ste 500 • Anchorage AK 9950�-3566

License number

Examined by

Telephone 907.269.6620 • FAX 907.269.6644

Email dor.tax.motorfuel@alaska.gov

407

Retain a copy for your records

Form 0405-407 web rev 08/07 • page �

1

1