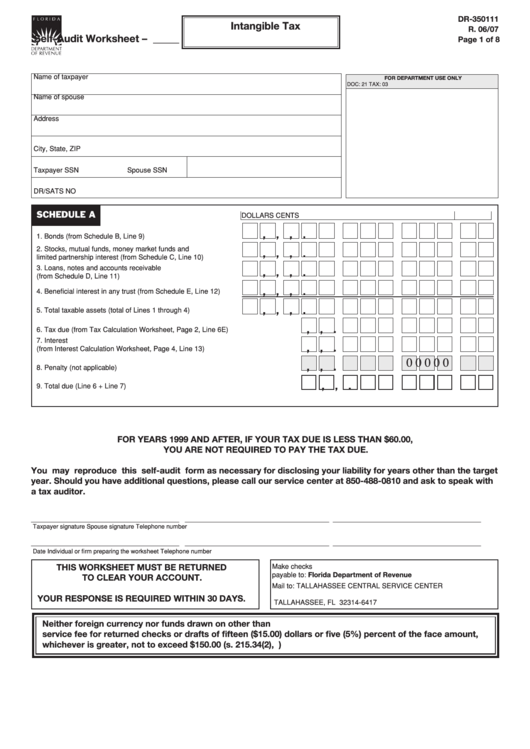

Form Dr-350111 - Intangible Tax Self_audit Worksheet

ADVERTISEMENT

DR-350111

Intangible Tax

R. 06/07

Self-Audit Worksheet – _____

Page 1 of 8

Name of taxpayer

FOR DEPARTMENT USE ONLY

DOC: 21

TAX: 03

Name of spouse

Address

City, State, ZIP

Taxpayer SSN

Spouse SSN

DR/SATS NO

schedule A

DOLLARS

CENTS

,

,

,

.

1. Bonds (from Schedule B, Line 9) ........................................... 1.

2. Stocks, mutual funds, money market funds and

,

,

,

.

limited partnership interest (from Schedule C, Line 10) ......... 2.

3. Loans, notes and accounts receivable

,

,

,

.

(from Schedule D, Line 11) ..................................................... 3.

,

,

,

.

4. Beneficial interest in any trust (from Schedule E, Line 12) ..... 4.

,

,

,

.

5. Total taxable assets (total of Lines 1 through 4) ..................... 5.

,

,

.

6. Tax due (from Tax Calculation Worksheet, Page 2, Line 6E) ............................... 6.

7. Interest

,

,

.

(from Interest Calculation Worksheet, Page 4, Line 13) ....................................... 7.

0 0 0

0 0

,

,

.

8. Penalty (not applicable) ........................................................................................ 8.

,

,

.

9. Total due (Line 6 + Line 7) .................................................................................... 9.

FOR YEARS 1999 AND AFTER, IF YOUR TAx DUE IS LESS ThAN $60.00,

YOU ARE NOT REqUIRED TO PAY ThE TAx DUE.

You may reproduce this self-audit form as necessary for disclosing your liability for years other than the target

year. Should you have additional questions, please call our service center at 850-488-0810 and ask to speak with

a tax auditor.

______________________________________

_____________________________________

______________________________________

Taxpayer signature

Spouse signature

Telephone number

______________________________________

_____________________________________

______________________________________

Date

Individual or firm preparing the worksheet

Telephone number

ThIS WORkShEET MUST bE RETURNED

Make checks

payable to:

Florida Department of Revenue

TO cLEAR YOUR AccOUNT.

Mail to:

TALLAhASSEE CENTRAL SERvICE CENTER

P.O. BOX 6417

YOUR RESPONSE IS REqUIRED WIThIN 30 DAYS.

TALLAhASSEE, FL 32314-6417

Neither foreign currency nor funds drawn on other than U.S. banks will be accepted. Florida law requires a

service fee for returned checks or drafts of fifteen ($15.00) dollars or five (5%) percent of the face amount,

whichever is greater, not to exceed $150.00 (s. 215.34(2), F.S.)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8