Form Rpd-41158 * Purchase Order For New Mexico Cigarette Stamps

ADVERTISEMENT

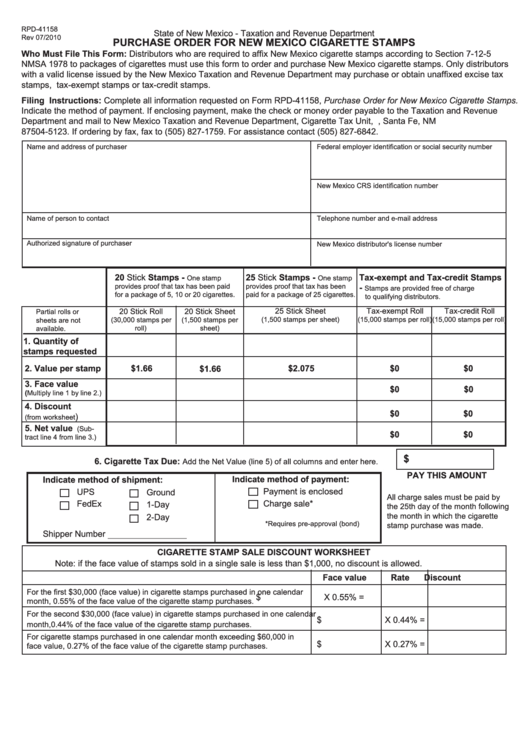

RPD-41158

State of New Mexico - Taxation and Revenue Department

Rev 07/2010

PURCHASE ORDER FOR NEW MEXICO CIGARETTE STAMPS

Who Must File This Form: Distributors who are required to affix New Mexico cigarette stamps according to Section 7-12-5

NMSA 1978 to packages of cigarettes must use this form to order and purchase New Mexico cigarette stamps. Only distributors

with a valid license issued by the New Mexico Taxation and Revenue Department may purchase or obtain unaffixed excise tax

stamps, tax-exempt stamps or tax-credit stamps.

Filing Instructions: Complete all information requested on Form RPD-41158, Purchase Order for New Mexico Cigarette Stamps.

Indicate the method of payment. If enclosing payment, make the check or money order payable to the Taxation and Revenue

Department and mail to New Mexico Taxation and Revenue Department, Cigarette Tax Unit, P.O. Box 25123, Santa Fe, NM

87504-5123. If ordering by fax, fax to (505) 827-1759. For assistance contact (505) 827-6842.

Name and address of purchaser

Federal employer identification or social security number

New Mexico CRS identification number

Name of person to contact

Telephone number and e-mail address

Authorized signature of purchaser

New Mexico distributor's license number

20 Stick Stamps -

25 Stick Stamps -

Tax-exempt and Tax-credit Stamps

One stamp

One stamp

provides proof that tax has been paid

provides proof that tax has been

-

Stamps are provided free of charge

for a package of 5, 10 or 20 cigarettes.

paid for a package of 25 cigarettes.

to qualifying distributors.

20 Stick Roll

20 Stick Sheet

25 Stick Sheet

Tax-exempt Roll

Tax-credit Roll

Partial rolls or

(30,000 stamps per

(1,500 stamps per

(1,500 stamps per sheet)

(15,000 stamps per roll)

(15,000 stamps per roll)

sheets are not

roll)

sheet)

available.

1. Quantity of

stamps requested

2. Value per stamp

$2.075

$0

$0

$1.66

$1.66

3. Face value

$0

$0

(Multiply line 1 by line 2.)

4. Discount

$0

$0

)

(from worksheet

5. Net value

(Sub-

$0

$0

tract line 4 from line 3.)

$

6. Cigarette Tax Due:

Add the Net Value (line 5) of all columns and enter here.

PAY THIS AMOUNT

Indicate method of payment:

Indicate method of shipment:

Payment is enclosed

UPS

Ground

All charge sales must be paid by

Charge sale*

FedEx

1-Day

the 25th day of the month following

the month in which the cigarette

2-Day

*Requires pre-approval (bond)

stamp purchase was made.

Shipper Number __________________

CIGARETTE STAMP SALE DISCOUNT WORKSHEET

Note: if the face value of stamps sold in a single sale is less than $1,000, no discount is allowed.

Face value

Rate

Discount

For the first $30,000 (face value) in cigarette stamps purchased in one calendar

$

X 0.55% =

month, 0.55% of the face value of the cigarette stamp purchases.

For the second $30,000 (face value) in cigarette stamps purchased in one calendar

$

X 0.44% =

month, 0.44% of the face value of the cigarette stamp purchases.

For cigarette stamps purchased in one calendar month exceeding $60,000 in

$

X 0.27% =

face value, 0.27% of the face value of the cigarette stamp purchases.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2