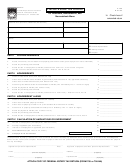

Form F-1065 - Florida Partnership Information Return Page 2

ADVERTISEMENT

F-1065

R. 01/07

Page 2

NOTE: Please read instructions (Form F-1065N) before completing the schedules below.

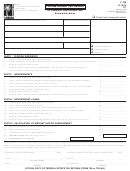

Part III.

Apportionment Information

III-A.

For use by partnerships doing business both within

(a) Within Florida

(b) Total Everywhere

and without Florida

1. Average value of property per Schedule III-C (Line 8)

$

$

2. Salaries, wages, commissions, and other compensation paid or accrued in

connection with trade or business for the period covered by this return

3. Sales

III-B.

For use by partnerships providing transportation

(a) Within Florida

(b) Total Everywhere

services within and without Florida

1. Transportation services revenue miles (see instructions)

Within Florida

Total Everywhere

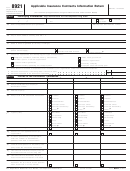

III-C.

For use in computing average value of property

a. Beginning of Year

b. End of Year

a. Beginning of Year

b. End of Year

1. Inventories of raw material, work in process, finished goods

2. Buildings and other depreciable assets (at original cost)

3. Land owned (at original cost)

4. Other tangible assets (at original cost) and intangible assets

(financial organizations only). Attach schedule

5. Total (Lines 1 through 4)

6. Average value of property [add Line 5 Columns (a) and (b)

and divide by 2 (for Within Florida and Total Everywhere)].

7. Rented property - (8 times net annual rent)

8. Total (Lines 6 and 7). Enter on Part III-A, Line 1, Column (a)

$_________________________

$_________________________

and (b)

Average Florida

Average Everywhere

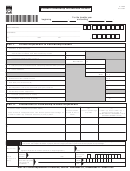

Part IV.

Apportionment of Partners' Share

Percent of

Property Data

Payroll Data

Sales Data

Partner (Name and Address)

Interest In

Within Florida

Everywhere

Within Florida

Everywhere

Within Florida

Everywhere

Partnership

A.

B.

C.

NOTE: Transfer data to Schedule III - A, Form F-1120.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2