Clear Form

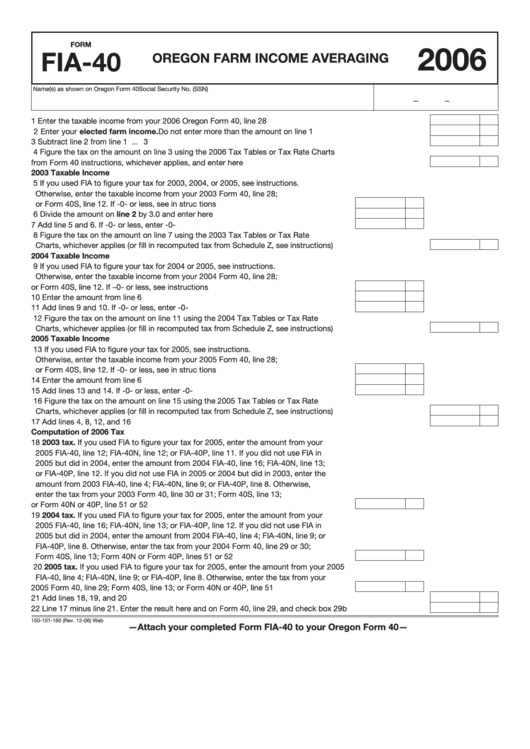

FORM

2006

FIA-40

OREGON FARM INCOME AVERAGING

Name(s) as shown on Oregon Form 40

Social Security No. (SSN)

—

—

1 Enter the taxable income from your 2006 Oregon Form 40, line 28 ................................................................. 1

2 Enter your elected farm income. Do not enter more than the amount on line 1 ............................................. 2

3 Subtract line 2 from line 1 .................................................................................................................................. 3

4 Figure the tax on the amount on line 3 using the 2006 Tax Tables or Tax Rate Charts

from Form 40 instructions, whichever applies, and enter here ......................................................................... 4

2003 Taxable Income

5 If you used FIA to figure your tax for 2003, 2004, or 2005, see instructions.

Otherwise, enter the taxable income from your 2003 Form 40, line 28;

or Form 40S, line 12. If -0- or less, see in struc tions ....................................................... 5

6 Divide the amount on line 2 by 3.0 and enter here ........................................................ 6

7 Add line 5 and 6. If -0- or less, enter -0- ........................................................................ 7

8 Figure the tax on the amount on line 7 using the 2003 Tax Tables or Tax Rate

Charts, whichever applies (or fill in recomputed tax from Schedule Z, see instructions) ................................... 8

2004 Taxable Income

9 If you used FIA to figure your tax for 2004 or 2005, see instructions.

Otherwise, enter the taxable income from your 2004 Form 40, line 28;

or Form 40S, line 12. If –0- or less, see instructions ......................................................

9

10 Enter the amount from line 6 .......................................................................................... 10

11 Add lines 9 and 10. If -0- or less, enter -0- .................................................................... 11

12 Figure the tax on the amount on line 11 using the 2004 Tax Tables or Tax Rate

Charts, whichever applies (or fill in recomputed tax from Schedule Z, see instructions) ................................... 12

2005 Taxable Income

13 If you used FIA to figure your tax for 2005, see instructions.

Otherwise, enter the taxable income from your 2005 Form 40, line 28;

or Form 40S, line 12. If -0- or less, see in struc tions ....................................................... 13

14 Enter the amount from line 6 .......................................................................................... 14

15 Add lines 13 and 14. If -0- or less, enter -0- .................................................................. 15

16 Figure the tax on the amount on line 15 using the 2005 Tax Tables or Tax Rate

Charts, whichever applies (or fill in recomputed tax from Schedule Z, see instructions) ................................... 16

17 Add lines 4, 8, 12, and 16 ................................................................................................................................... 17

Computation of 2006 Tax

18 2003 tax. If you used FIA to figure your tax for 2005, enter the amount from your

2005 FIA-40, line 12; FIA-40N, line 12; or FIA-40P, line 11. If you did not use FIA in

2005 but did in 2004, enter the amount from 2004 FIA-40, line 16; FIA-40N, line 13;

or FIA-40P, line 12. If you did not use FIA in 2005 or 2004 but did in 2003, enter the

amount from 2003 FIA-40, line 4; FIA-40N, line 9; or FIA-40P, line 8. Otherwise,

enter the tax from your 2003 Form 40, line 30 or 31; Form 40S, line 13;

or Form 40N or 40P, line 51 or 52 ................................................................................... 18

19 2004 tax. If you used FIA to figure your tax for 2005, enter the amount from your

2005 FIA-40, line 16; FIA-40N, line 13; or FIA-40P, line 12. If you did not use FIA in

2005 but did in 2004, enter the amount from 2004 FIA-40, line 4; FIA-40N, line 9; or

FIA-40P, line 8. Otherwise, enter the tax from your 2004 Form 40, line 29 or 30;

Form 40S, line 13; Form 40N or Form 40P, lines 51 or 52 ............................................. 19

20 2005 tax. If you used FIA to figure your tax for 2005, enter the amount from your 2005

FIA-40, line 4; FIA-40N, line 9; or FIA-40P, line 8. Otherwise, enter the tax from your

2005 Form 40, line 29; Form 40S, line 13; or Form 40N or 40P, line 51 .......................... 20

21 Add lines 18, 19, and 20 ..................................................................................................................................... 21

22 Line 17 minus line 21. Enter the result here and on Form 40, line 29, and check box 29b ................................ 22

150-101-160 (Rev. 12-06) Web

—Attach your completed Form FIA-40 to your Oregon Form 40—

1

1