Form Dr-405ez - Tangible Personal Property Exemption Application And Return - 2008

ADVERTISEMENT

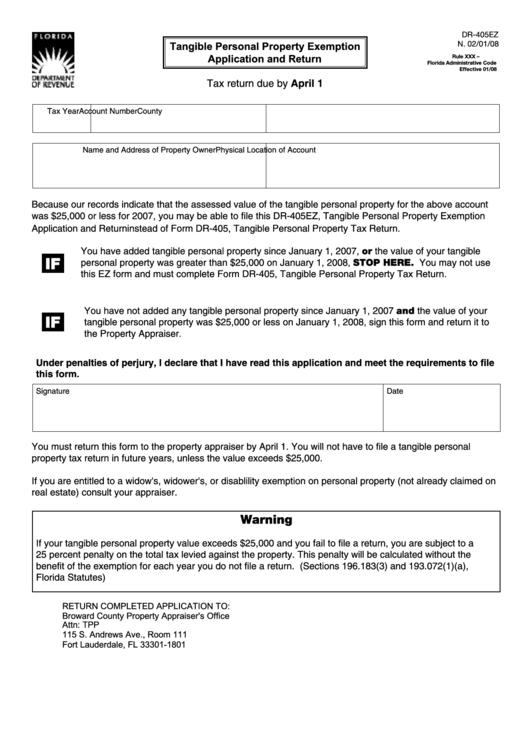

DR-405EZ

N. 02/01/08

Tangible Personal Property Exemption

Application and Return

Rule XXX – X.XXX

Florida Administrative Code

Effective 01/08

Tax return due by April 1

Tax Year

Account Number

County

Name and Address of Property Owner

Physical Location of Account

Because our records indicate that the assessed value of the tangible personal property for the above account

was $25,000 or less for 2007, you may be able to file this DR-405EZ, Tangible Personal Property Exemption

Application and Return instead of Form DR-405, Tangible Personal Property Tax Return.

You have added tangible personal property since January 1, 2007, or the value of your tangible

IF

personal property was greater than $25,000 on January 1, 2008, stop here. You may not use

this EZ form and must complete Form DR-405, Tangible Personal Property Tax Return.

You have not added any tangible personal property since January 1, 2007 and the value of your

IF

tangible personal property was $25,000 or less on January 1, 2008, sign this form and return it to

the Property Appraiser.

Under penalties of perjury, I declare that I have read this application and meet the requirements to file

this form.

Signature

Date

You must return this form to the property appraiser by April 1. You will not have to file a tangible personal

property tax return in future years, unless the value exceeds $25,000.

If you are entitled to a widow's, widower's, or disablility exemption on personal property (not already claimed on

real estate) consult your appraiser.

Warning

If your tangible personal property value exceeds $25,000 and you fail to file a return, you are subject to a

25 percent penalty on the total tax levied against the property. This penalty will be calculated without the

benefit of the exemption for each year you do not file a return. (Sections 196.183(3) and 193.072(1)(a),

Florida Statutes)

RETURN COMPLETED APPLICATION TO:

Broward County Property Appraiser's Office

Attn: TPP

115 S. Andrews Ave., Room 111

Fort Lauderdale, FL 33301-1801

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1