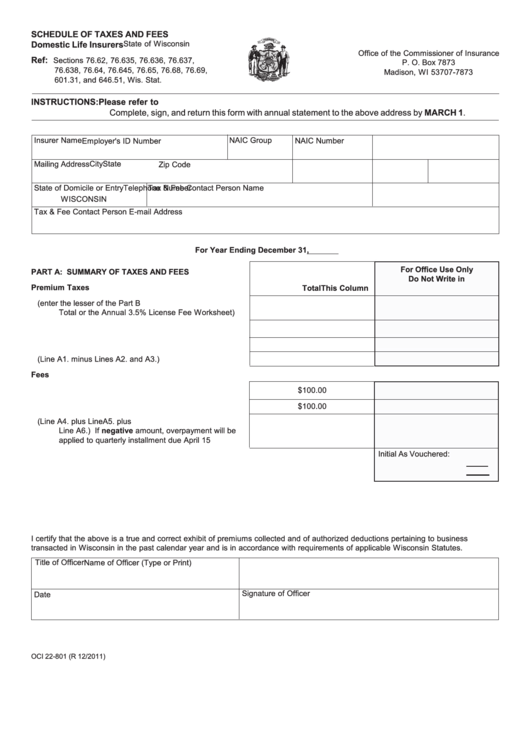

Form Oci 22-801 - Schedule Of Taxes And Fees Template - Wisconsin

ADVERTISEMENT

SCHEDULE OF TAXES AND FEES

State of Wisconsin

Domestic Life Insurers

Office of the Commissioner of Insurance

Ref:

Sections 76.62, 76.635, 76.636, 76.637,

P. O. Box 7873

76.638, 76.64, 76.645, 76.65, 76.68, 76.69,

Madison, WI 53707-7873

601.31, and 646.51, Wis. Stat.

INSTRUCTIONS:

Please refer to for remittance of taxes and fees.

Complete, sign, and return this form with annual statement to the above address by MARCH 1.

NAIC Group

Insurer Name

NAIC Number

Employer's ID Number

Mailing Address

City

State

Zip Code

State of Domicile or Entry

Telephone Number

Tax & Fee Contact Person Name

WISCONSIN

Tax & Fee Contact Person E-mail Address

For Year Ending December 31,

For Office Use Only

PART A: SUMMARY OF TAXES AND FEES

Do Not Write in

Premium Taxes

Total

This Column

A1.

Total Taxes Payable (enter the lesser of the Part B

Total or the Annual 3.5% License Fee Worksheet)

A2.

Prior Year Overpayment

A3.

Quarterly Tax Payments to Date

A4.

Net Tax Due (Line A1. minus Lines A2. and A3.)

Fees

$100.00

A5.

Annual Statement Filing Fee

A6.

Certificate of Authority Fee

$100.00

A7.

Net Taxes and Fees Due (Line A4. plus LineA5. plus

Line A6.) If negative amount, overpayment will be

applied to quarterly installment due April 15

Initial As Vouchered:

1. To Allocation Screen

2. To Amount in Letter

I certify that the above is a true and correct exhibit of premiums collected and of authorized deductions pertaining to business

transacted in Wisconsin in the past calendar year and is in accordance with requirements of applicable Wisconsin Statutes.

Title of Officer

Name of Officer (Type or Print)

Signature of Officer

Date

OCI 22-801 (R 12/2011)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6