Sales And Use Tax Report Form - Baton Rouge - Louisiana

ADVERTISEMENT

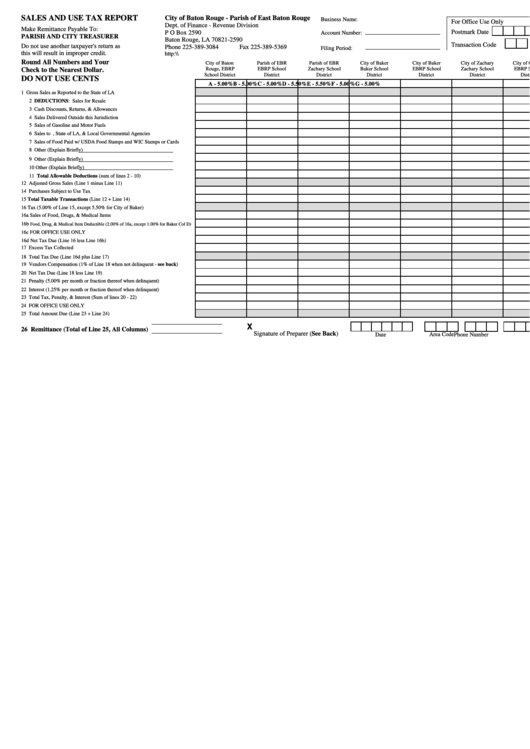

SALES AND USE TAX REPORT

City of Baton Rouge - Parish of East Baton Rouge

Business Name:

For Office Use Only

Dept. of Finance - Revenue Division

Make Remittance Payable To:

Postmark Date

P O Box 2590

Account Number:

PARISH AND CITY TREASURER

Baton Rouge, LA 70821-2590

Transaction Code

Do not use another taxpayer's return as

Phone 225-389-3084

Fax 225-389-5369

Filing Period:

this will result in improper credit.

http:\\

Round All Numbers and Your

City of Baton

Parish of EBR

Parish of EBR

City of Baker

City of Baker

City of Zachary

City of Central

Check to the Nearest Dollar.

Rouge, EBRP

EBRP School

Zachary School

Baker School

EBRP School

Zachary School

EBRP School

School District

District

District

District

District

District

District

DO NOT USE CENTS

A - 5.00%

B - 5.00%

C - 5.00%

D - 5.50%

E - 5.50%

F - 5.00%

G - 5.00%

1 Gross Sales as Reported to the State of LA

2 DEDUCTIONS: Sales for Resale

3 Cash Discounts, Returns, & Allowances

4 Sales Delivered Outside this Jurisdiction

5 Sales of Gasoline and Motor Fuels

6 Sales to U.S. Government, State of LA, & Local Governmental Agencies

7 Sales of Food Paid w/ USDA Food Stamps and WIC Stamps or Cards

8 Other (Explain Briefly)

9 Other (Explain Briefly)

10 Other (Explain Briefly)

11 Total Allowable Deductions (sum of lines 2 - 10)

12 Adjusted Gross Sales (Line 1 minus Line 11)

14 Purchases Subject to Use Tax

15 Total Taxable Transactions (Line 12 + Line 14)

16 Tax (5.00% of Line 15, except 5.50% for City of Baker)

16a Sales of Food, Drugs, & Medical Items

16b

Food, Drug, & Medical Item Deductible (2.00% of 16a, except 1.00% for Baker Col D)

16c FOR OFFICE USE ONLY

16d Net Tax Due (Line 16 less Line 16b)

17 Excess Tax Collected

18 Total Tax Due (Line 16d plus Line 17)

19 Vendors Compensation (1% of Line 18 when not delinquent - see back)

20 Net Tax Due (Line 18 less Line 19)

21 Penalty (5.00% per month or fraction thereof when delinquent)

22 Interest (1.25% per month or fraction thereof when delinquent)

23 Total Tax, Penalty, & Interest (Sum of lines 20 - 22)

24 FOR OFFICE USE ONLY

25 Total Amount Due (Line 23 + Line 24)

X

26 Remittance (Total of Line 25, All Columns)

Signature of Preparer (See Back)

Area Code

Date

Phone Number

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2