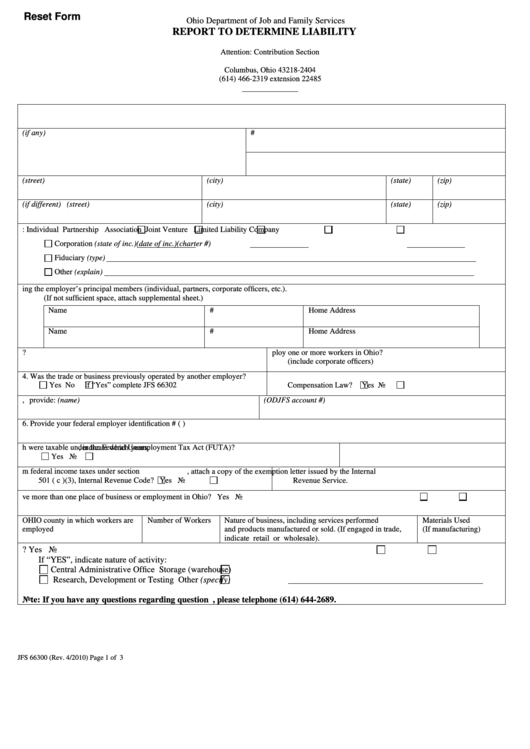

Reset Form

Ohio Department of Job and Family Services

REPORT TO DETERMINE LIABILITY

Attention: Contribution Section

P.O. Box 182404

Columbus, Ohio 43218-2404

(614) 466-2319 extension 22485

1.a. Employer Name

1.b. Employer Trade name (if any)

1.c. Telephone #

1.d. E-mail Address

1.e. Physical Business Address (street)

(city)

(state)

(zip)

1.f. Mailing Address (if different) (street)

(city)

(state)

(zip)

2.a.

Type of business operation:

Individual

Partnership

Association

Joint Venture

Limited Liability Company

Corporation (state of inc.)

(date of inc.)

(charter #)

Fiduciary (type)

Other (explain)

2.b.

Provide the following information regarding the employer’s principal members (individual, partners, corporate officers, etc.).

(If not sufficient space, attach supplemental sheet.)

Name

S.S.#

Home Address

Name

S.S.#

Home Address

3.a. On what date did you begin operations in Ohio?

3.b. On what date did you first employ one or more workers in Ohio?

(include corporate officers)

4.

Was the trade or business previously operated by another employer?

5.a. Have you previously been subject to the Ohio Unemployment

Yes

No

If “Yes” complete JFS 66302

Compensation Law?

Yes

No

5.b. If yes, provide: (name)

(ODJFS account #)

6.

Provide your federal employer identification # (I.R.S.)

7.a. Have you paid wages which were taxable under the Federal Unemployment Tax Act (FUTA)?

7.b. If yes, indicate which years.

Yes

No

8.a. Is your enterprise exempt from federal income taxes under section

8.b. If yes, attach a copy of the exemption letter issued by the Internal

501 ( c )(3), Internal Revenue Code?

Yes

No

Revenue Service.

9.a. Describe fully the type of business you operate. Do you have more than one place of business or employment in Ohio?

Yes

No

OHIO county in which workers are

Number of Workers

Nature of business, including services performed

Materials Used

employed

and products manufactured or sold. (If engaged in trade,

(If manufacturing)

indicate retail or wholesale).

9.b. Is the establishment primarily engaged in performing services for other units of the company?

Yes

No

If “YES”, indicate nature of activity:

Central Administrative Office

Storage (warehouse)

Research, Development or Testing

Other (specify)

Note: If you have any questions regarding question 9.a. or 9.b., please telephone (614) 644-2689.

JFS 66300 (Rev. 4/2010)

Page 1 of 3

1

1 2

2