Form Wv/cfs-1 - Convenience Food Store Tax Credit Schedule

ADVERTISEMENT

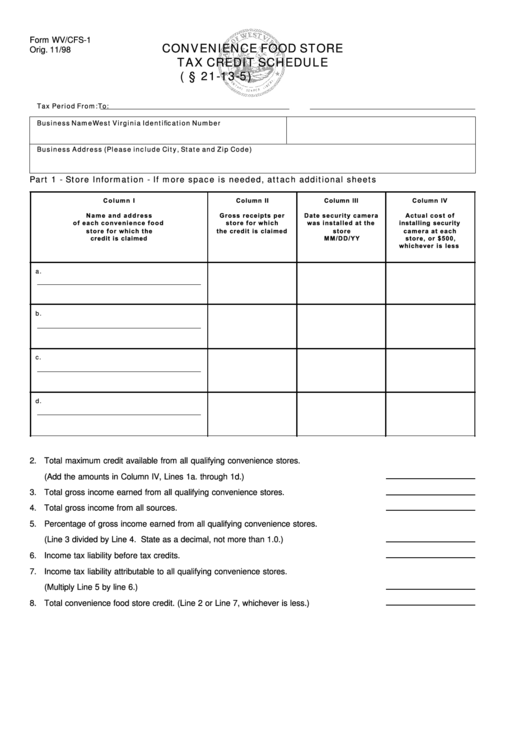

Form WV/CFS-1

CONVENIENCE FOOD STORE

Orig. 11/98

TAX CREDIT SCHEDULE

(W.Va. Code § 21-13-5)

Tax Period From:

To:

Business Name

West Virginia Identification Number

Business Address (Please include City, State and Zip Code)

Part 1 - Store Information - If more space is needed, attach additional sheets

C o l u m n I

Column II

Column III

Column IV

N a m e a n d a d d r e s s

Gross receipts per

D a t e s e c u r i t y c a m e r a

A c t u a l c o s t o f

o f e a c h c o n v e n i e n c e f o o d

s t o r e f o r w h i c h

w a s i n s t a l l e d a t t h e

installing security

s t o r e f o r w h i c h t h e

the credit is claimed

store

c a m e r a a t e a c h

credit is claimed

M M / D D / YY

store, or $500,

whichever is less

a .

b .

c .

d .

2. Total maximum credit available from all qualifying convenience stores.

(Add the amounts in Column IV, Lines 1a. through 1d.) .......................................................

3. Total gross income earned from all qualifying convenience stores. .......................................

4. Total gross income from all sources. ..................................................................................

5. Percentage of gross income earned from all qualifying convenience stores.

(Line 3 divided by Line 4. State as a decimal, not more than 1.0.) .......................................

6. Income tax liability before tax credits. .................................................................................

7. Income tax liability attributable to all qualifying convenience stores.

(Multiply Line 5 by line 6.) ..................................................................................................

8. Total convenience food store credit. (Line 2 or Line 7, whichever is less.) .............................

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1