Form Ip-1 - Insurance Premium Tax Return - 2007

ADVERTISEMENT

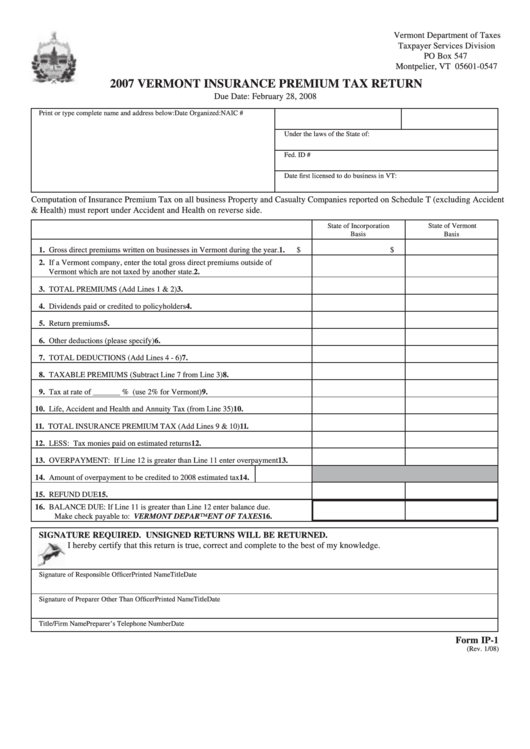

Vermont Department of Taxes

Taxpayer Services Division

PO Box 547

Montpelier, VT 05601-0547

2007 VERMONT INSURANCE PREMIUM TAX RETURN

Due Date: February 28, 2008

Print or type complete name and address below:

Date Organized:

NAIC #

Under the laws of the State of:

Fed. ID #

Date first licensed to do business in VT:

Computation of Insurance Premium Tax on all business Property and Casualty Companies reported on Schedule T (excluding Accident

& Health) must report under Accident and Health on reverse side.

State of Incorporation

State of Vermont

Basis

Basis

1. Gross direct premiums written on businesses in Vermont during the year.

1.

$

$

2. If a Vermont company, enter the total gross direct premiums outside of

Vermont which are not taxed by another state.

2.

3. TOTAL PREMIUMS (Add Lines 1 & 2)

3.

4. Dividends paid or credited to policyholders

4.

5. Return premiums

5.

6. Other deductions (please specify)

6.

7. TOTAL DEDUCTIONS (Add Lines 4 - 6)

7.

8. TAXABLE PREMIUMS (Subtract Line 7 from Line 3)

8.

9. Tax at rate of _______ % (use 2% for Vermont)

9.

10. Life, Accident and Health and Annuity Tax (from Line 35)

10.

11. TOTAL INSURANCE PREMIUM TAX (Add Lines 9 & 10)

11.

12. LESS: Tax monies paid on estimated returns

12.

13. OVERPAYMENT: If Line 12 is greater than Line 11 enter overpayment

13.

14. Amount of overpayment to be credited to 2008 estimated tax 14.

15. REFUND DUE

15.

16. BALANCE DUE: If Line 11 is greater than Line 12 enter balance due.

Make check payable to: VERMONT DEPARTMENT OF TAXES

16.

SIGNATURE REQUIRED. UNSIGNED RETURNS WILL BE RETURNED.

I hereby certify that this return is true, correct and complete to the best of my knowledge.

Signature of Responsible Officer

Printed Name

Title

Date

Signature of Preparer Other Than Officer

Printed Name

Title

Date

Title/Firm Name

Preparer’s Telephone Number

Date

Form IP-1

(Rev. 1/08)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2