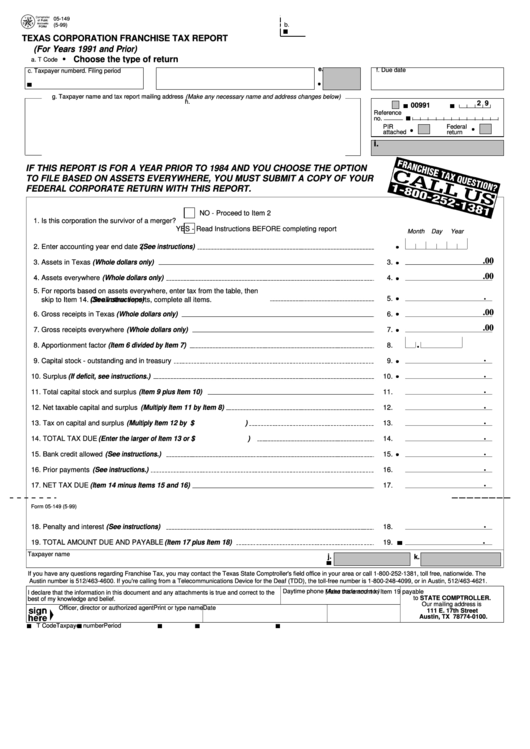

REFER TO INSTRUCTIONS

05-149

ON FORM 05-357

b.

(5-99)

TEXAS CORPORATION FRANCHISE TAX REPORT

(For Years 1991 and Prior)

Choose the type of return

a. T Code

e.

f. Due date

c. Taxpayer number

d. Filing period

g. Taxpayer name and tax report mailing address

(Make any necessary name and address changes below)

h.

2 9

00991

Reference

no.

PIR

Federal

attached

return

i.

IF THIS REPORT IS FOR A YEAR PRIOR TO 1984 AND YOU CHOOSE THE OPTION

TO FILE BASED ON ASSETS EVERYWHERE, YOU MUST SUBMIT A COPY OF YOUR

FEDERAL CORPORATE RETURN WITH THIS REPORT.

NO - Proceed to Item 2

1. Is this corporation the survivor of a merger?

YES - Read Instructions BEFORE completing report

Month

Day

Year

(See instructions)

2. Enter accounting year end date

2.

.00

(Whole dollars only)

3. Assets in Texas

3.

.00

(Whole dollars only)

4. Assets everywhere

4.

5. For reports based on assets everywhere, enter tax from the table, then

.

5.

(See instructions)

skip to Item 14.

On all other reports, complete all items.

.00

(Whole dollars only)

6. Gross receipts in Texas

6.

.00

(Whole dollars only)

7. Gross receipts everywhere

7.

.

(Item 6 divided by Item 7)

8. Apportionment factor

8.

.

9. Capital stock - outstanding and in treasury

9.

.

(If deficit, see instructions.)

10. Surplus

10.

.

(Item 9 plus Item 10)

11. Total capital stock and surplus

11.

.

(Multiply Item 11 by Item 8)

12. Net taxable capital and surplus

12.

.

(Multiply Item 12 by $

)

13. Tax on capital and surplus

13.

.

(Enter the larger of Item 13 or $

)

14. TOTAL TAX DUE

14.

.

(See instructions.)

15. Bank credit allowed

15.

.

(See instructions.)

16. Prior payments

16.

.

(Item 14 minus Items 15 and 16)

17. NET TAX DUE

17.

Form 05-149 (5-99)

.

(See instructions)

18. Penalty and interest

18.

.

19. TOTAL AMOUNT DUE AND PAYABLE

(Item 17 plus Item 18)

19.

Taxpayer name

j.

k.

If you have any questions regarding Franchise Tax, you may contact the Texas State Comptroller's field office in your area or call 1-800-252-1381, toll free, nationwide. The

Austin number is 512/463-4600. If you're calling from a Telecommunications Device for the Deaf (TDD), the toll-free number is 1-800-248-4099, or in Austin, 512/463-4621.

Daytime phone

(Area code and no.)

Make the amount in Item 19 payable

I declare that the information in this document and any attachments is true and correct to the

to

STATE COMPTROLLER.

best of my knowledge and belief.

Our mailing address is

Officer, director or authorized agent

Print or type name

Date

111 E. 17th Street

Austin, TX 78774-0100.

T Code

Taxpayer number

Period

1

1