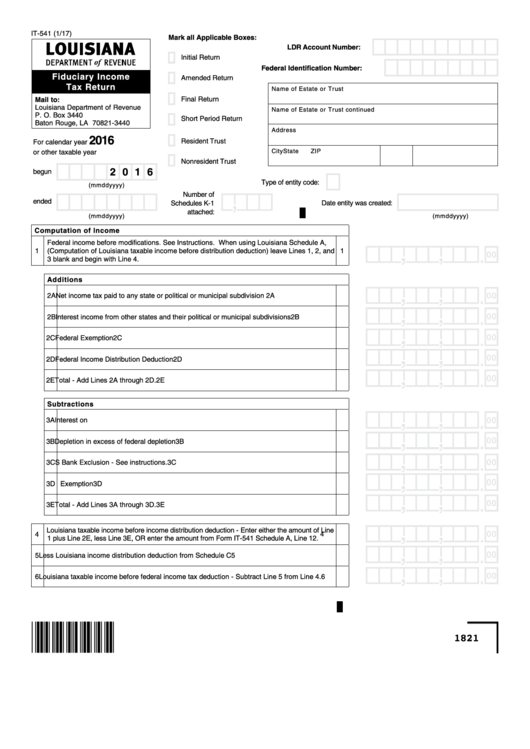

IT-541 (1/17)

Mark all Applicable Boxes:

LDR Account Number:

Initial Return

Federal Identification Number:

Fiduciary Income

Amended Return

Tax Return

Name of Estate or Trust

Mail to:

Final Return

Louisiana Department of Revenue

Name of Estate or Trust continued

P. O. Box 3440

Short Period Return

Baton Rouge, LA 70821-3440

Address

2016

Resident Trust

For calendar year

City

State

ZIP

or other taxable year

Nonresident Trust

2 0 1 6

begun

Type of entity code:

(mmddyyyy)

Number of

ended

Date entity was created:

Schedules K-1

attached:

(mmddyyyy)

(mmddyyyy)

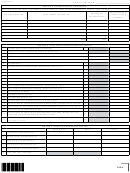

Computation of Income

Federal income before modifications. See Instructions. When using Louisiana Schedule A,

1

(Computation of Louisiana taxable income before distribution deduction) leave Lines 1, 2, and

1

3 blank and begin with Line 4.

Additions

2A Net income tax paid to any state or political or municipal subdivision

2A

2B Interest income from other states and their political or municipal subdivisions

2B

2C Federal Exemption

2C

2D Federal Income Distribution Deduction

2D

2E Total - Add Lines 2A through 2D.

2E

Subtractions

3A Interest on U.S. government obligations

3A

3B Depletion in excess of federal depletion

3B

3C S Bank Exclusion - See instructions.

3C

3D Exemption

3D

3E Total - Add Lines 3A through 3D.

3E

Louisiana taxable income before income distribution deduction - Enter either the amount of Line

4

4

1 plus Line 2E, less Line 3E, OR enter the amount from Form IT-541 Schedule A, Line 12.

5

Less Louisiana income distribution deduction from Schedule C

5

6

Louisiana taxable income before federal income tax deduction - Subtract Line 5 from Line 4.

6

1821

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8