Direct Shipper Tax Schedule 11

Download a blank fillable Direct Shipper Tax Schedule 11 in PDF format just by clicking the "DOWNLOAD PDF" button.

Open the file in any PDF-viewing software. Adobe Reader or any alternative for Windows or MacOS are required to access and complete fillable content.

Complete Direct Shipper Tax Schedule 11 with your personal data - all interactive fields are highlighted in places where you should type, access drop-down lists or select multiple-choice options.

Some fillable PDF-files have the option of saving the completed form that contains your own data for later use or sending it out straight away.

ADVERTISEMENT

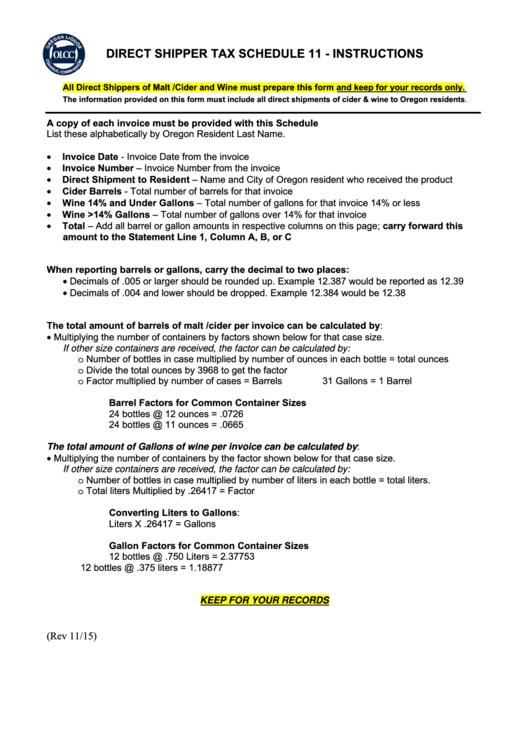

DIRECT SHIPPER TAX SCHEDULE 11 - INSTRUCTIONS

All Direct Shippers of Malt /Cider and Wine must prepare this form and keep for your records only.

The information provided on this form must include all direct shipments of cider & wine to Oregon residents.

A copy of each invoice must be provided with this Schedule

List these alphabetically by Oregon Resident Last Name.

•

Invoice Date - Invoice Date from the invoice

•

Invoice Number – Invoice Number from the invoice

•

Direct Shipment to Resident – Name and City of Oregon resident who received the product

•

Cider Barrels - Total number of barrels for that invoice

•

Wine 14% and Under Gallons – Total number of gallons for that invoice 14% or less

•

Wine >14% Gallons – Total number of gallons over 14% for that invoice

•

Total – Add all barrel or gallon amounts in respective columns on this page; carry forward this

amount to the Statement Line 1, Column A, B, or C

When reporting barrels or gallons, carry the decimal to two places:

•

Decimals of .005 or larger should be rounded up. Example 12.387 would be reported as 12.39

•

Decimals of .004 and lower should be dropped. Example 12.384 would be 12.38

The total amount of barrels of malt /cider per invoice can be calculated by:

•

Multiplying the number of containers by factors shown below for that case size.

If other size containers are received, the factor can be calculated by:

o Number of bottles in case multiplied by number of ounces in each bottle = total ounces

o Divide the total ounces by 3968 to get the factor

o Factor multiplied by number of cases = Barrels

31 Gallons = 1 Barrel

Barrel Factors for Common Container Sizes

24 bottles @ 12 ounces = .0726

24 bottles @ 11 ounces = .0665

The total amount of Gallons of wine per invoice can be calculated by:

•

Multiplying the number of containers by the factor shown below for that case size.

If other size containers are received, the factor can be calculated by:

o Number of bottles in case multiplied by number of liters in each bottle = total liters.

o Total liters Multiplied by .26417 = Factor

Converting Liters to Gallons:

Liters X .26417 = Gallons

Gallon Factors for Common Container Sizes

12 bottles @ .750 Liters = 2.37753

12 bottles @ .375 liters = 1.18877

KEEP FOR YOUR RECORDS

(Rev 11/15)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2