Form Dr-228 - Documentary Stamp Tax Return For Nonregistered Taxpayers' Unrecorded Documents

ADVERTISEMENT

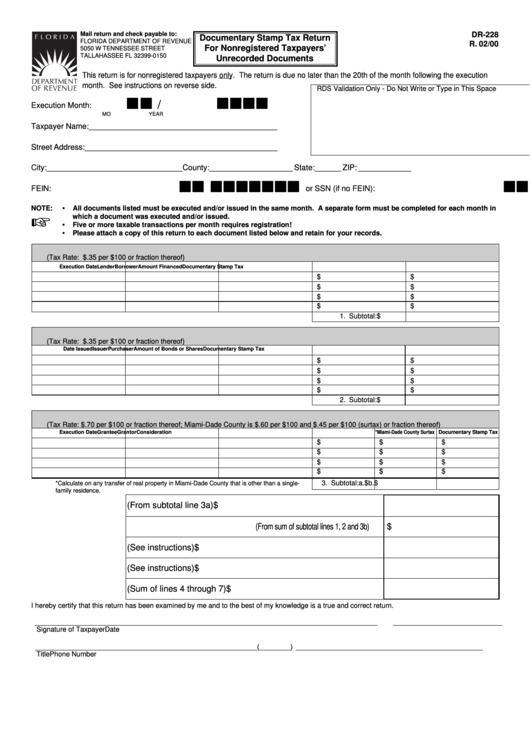

Mail return and check payable to:

DR-228

Documentary Stamp Tax Return

FLORIDA DEPARTMENT OF REVENUE

R. 02/00

For Nonregistered Taxpayers’

5050 W TENNESSEE STREET

TALLAHASSEE FL 32399-0150

Unrecorded Documents

This return is for nonregistered taxpayers only. The return is due no later than the 20th of the month following the execution

month. See instructions on reverse side.

RDS Validation Only - Do Not Write or Type in This Space

/

Execution Month:

MO

YEAR

Taxpayer Name: ___________________________________________

Street Address: ____________________________________________

City: _______________________________ County: ___________________ State: ______ ZIP: ____________

FEIN:

or SSN (if no FEIN):

NOTE:

All documents listed must be executed and/or issued in the same month. A separate form must be completed for each month in

•

which a document was executed and/or issued.

Five or more taxable transactions per month requires registration!

•

•

Please attach a copy of this return to each document listed below and retain for your records.

1. Notes and Other Written Obligations to Pay Money

(Tax Rate: $.35 per $100 or fraction thereof)

Execution Date

Lender

Borrower

Amount Financed

Documentary Stamp Tax

$

$

$

$

$

$

$

$

1. Subtotal:

$

2. Stocks and Bonds

(Tax Rate: $.35 per $100 or fraction thereof)

Date Issued

Issuer

Purchaser

Amount of Bonds or Shares

Documentary Stamp Tax

$

$

$

$

$

$

$

$

2. Subtotal:

$

3. Transfers of Interest of Real Property and/or Unrecorded Deeds

(Tax Rate: $.70 per $100 or fraction thereof; Miami-Dade County is $.60 per $100 and $.45 per $100 (surtax) or fraction thereof)

Execution Date

Grantee

Grantor

Consideration

*Miami-Dade County Surtax Documentary Stamp Tax

$

$

$

$

$

$

$

$

$

$

$

$

3. Subtotal:

a.$

b.$

*Calculate on any transfer of real property in Miami-Dade County that is other than a single-

family residence.

4. Miami-Dade County Surtax Due (From subtotal line 3a)

$

5. Documentary Stamp Tax Due (From sum of subtotal lines 1, 2 and 3b)

$

6. Penalty (See instructions)

$

7. Interest (See instructions)

$

8. Total Amount Due with Return (Sum of lines 4 through 7)

$

I hereby certify that this return has been examined by me and to the best of my knowledge is a true and correct return.

________________________________________________________________________________________

____________________________

Signature of Taxpayer

Date

_________________________________________________________

(________) ________________________________________________

Title

Phone Number

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1