Form St-103 - Sales Tax Vouchers And/or Electronic Funds Transfer Credit Recap

ADVERTISEMENT

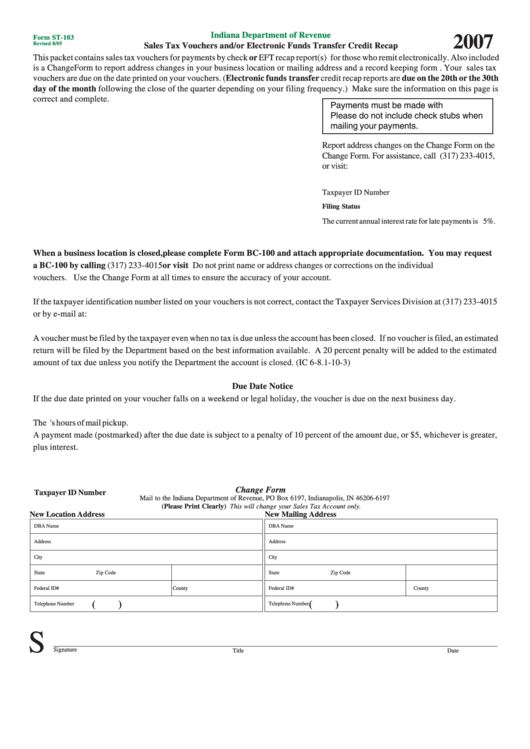

Indiana Department of Revenue

2007

Form ST-103

Revised 8/05

Sales Tax Vouchers and/or Electronic Funds Transfer Credit Recap

This packet contains sales tax vouchers for payments by check or EFT recap report(s) for those who remit electronically. Also included

is a Change Form to report address changes in your business location or mailing address and a record keeping form . Your sales tax

vouchers are due on the date printed on your vouchers. (Electronic funds transfer credit recap reports are due on the 20th or the 30th

day of the month following the close of the quarter depending on your filing frequency.) Make sure the information on this page is

correct and complete.

Payments must be made with U.S. funds.

Please do not include check stubs when

mailing your payments.

Report address changes on the Change Form on the

Change Form. For assistance, call (317) 233-4015,

or visit:

Taxpayer ID Number

Filing Status

The current annual interest rate for late payments is 5%.

When a business location is closed, please complete Form BC-100 and attach appropriate documentation. You may request

a BC-100 by calling (317) 233-4015 or visit Do not print name or address changes or corrections on the individual

vouchers. Use the Change Form at all times to ensure the accuracy of your account.

If the taxpayer identification number listed on your vouchers is not correct, contact the Taxpayer Services Division at (317) 233-4015

or by e-mail at:

A voucher must be filed by the taxpayer even when no tax is due unless the account has been closed. If no voucher is filed, an estimated

return will be filed by the Department based on the best information available. A 20 percent penalty will be added to the estimated

amount of tax due unless you notify the Department the account is closed. (IC 6-8.1-10-3)

Due Date Notice

If the due date printed on your voucher falls on a weekend or legal holiday, the voucher is due on the next business day.

The U.S. Postal Service postmark date determines if a return is timely. Please be aware of your local postal service's hours of mail pickup.

A payment made (postmarked) after the due date is subject to a penalty of 10 percent of the amount due, or $5, whichever is greater,

plus interest.

Change Form

Taxpayer ID Number

Mail to the Indiana Department of Revenue, PO Box 6197, Indianapolis, IN 46206-6197

(Please Print Clearly) This will change your Sales Tax Account only.

New Location Address

New Mailing Address

DBA Name

DBA Name

Address

Address

City

City

State

Zip Code

State

Zip Code

Federal ID#

County

Federal ID#

County

(

)

(

)

Telephone Number

Telephone Number

S

Signature

Title

Date

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2