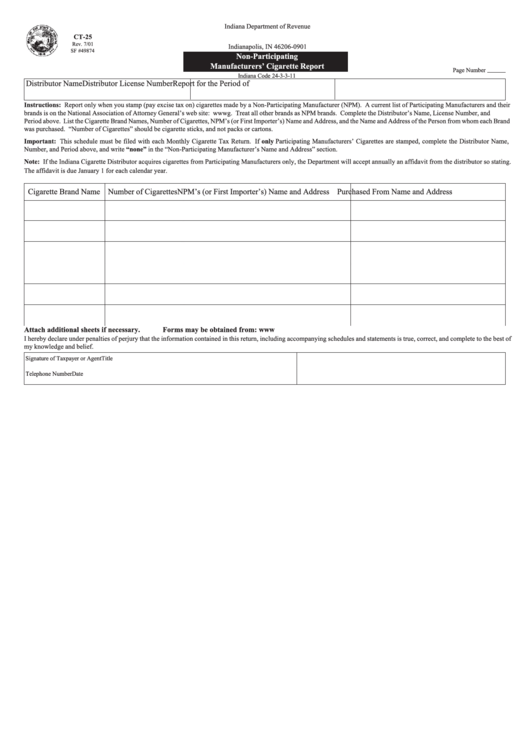

Form Ct-25 - Non Participating Manufacturers Cigarette Report

ADVERTISEMENT

Indiana Department of Revenue

P.O. Box 901

CT-25

Rev. 7/01

Indianapolis, IN 46206-0901

SF #49874

Non-Participating

Manufacturers’ Cigarette Report

Page Number

Indiana Code 24-3-3-11

Distributor Name

Distributor License Number

Report for the Period of

Instructions: Report only when you stamp (pay excise tax on) cigarettes made by a Non-Participating Manufacturer (NPM). A current list of Participating Manufacturers and their

brands is on the National Association of Attorney General’s web site: Treat all other brands as NPM brands. Complete the Distributor’s Name, License Number, and

Period above. List the Cigarette Brand Names, Number of Cigarettes, NPM’s (or First Importer’s) Name and Address, and the Name and Address of the Person from whom each Brand

was purchased. “Number of Cigarettes” should be cigarette sticks, and not packs or cartons.

Important: This schedule must be filed with each Monthly Cigarette Tax Return. If only Participating Manufacturers’ Cigarettes are stamped, complete the Distributor Name,

Number, and Period above, and write “none” in the “Non-Participating Manufacturer’s Name and Address” section.

Note: If the Indiana Cigarette Distributor acquires cigarettes from Participating Manufacturers only, the Department will accept annually an affidavit from the distributor so stating.

The affidavit is due January 1 for each calendar year.

Cigarette Brand Name Number of Cigarettes

NPM’s (or First Importer’s) Name and Address

Purchased From Name and Address

Attach additional sheets if necessary.

Forms may be obtained from:

I hereby declare under penalties of perjury that the information contained in this return, including accompanying schedules and statements is true, correct, and complete to the best of

my knowledge and belief.

Signature of Taxpayer or Agent

Title

Telephone Number

Date

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1