Form St-141 - Individual Purchaser'S Periodic Report Of Sales And Use Tax

ADVERTISEMENT

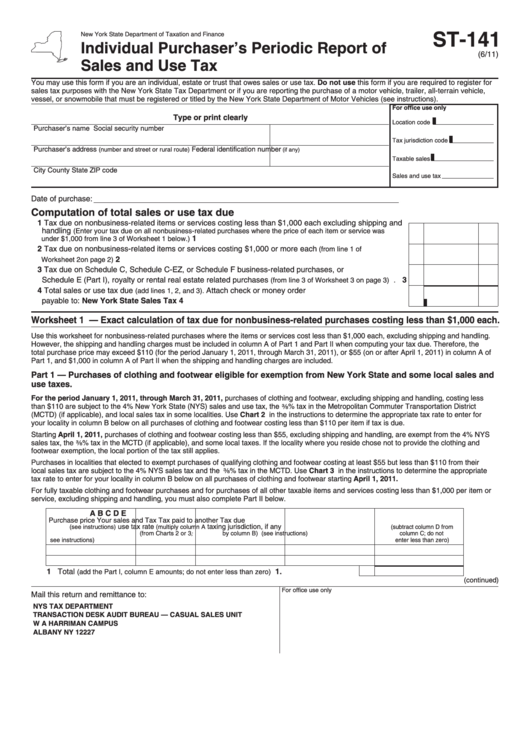

ST-141

New York State Department of Taxation and Finance

Individual Purchaser’s Periodic Report of

(6/11)

Sales and Use Tax

You may use this form if you are an individual, estate or trust that owes sales or use tax. Do not use this form if you are required to register for

sales tax purposes with the New York State Tax Department or if you are reporting the purchase of a motor vehicle, trailer, all-terrain vehicle,

vessel, or snowmobile that must be registered or titled by the New York State Department of Motor Vehicles (see instructions).

For office use only

Type or print clearly

Location code

Purchaser’s name

Social security number

Tax jurisdiction code

Purchaser’s address

Federal identification number

(number and street or rural route)

(if any)

Taxable sales

City

County

State

ZIP code

Sales and use tax

Date of purchase:

Computation of total sales or use tax due

1 Tax due on nonbusiness-related items or services costing less than $1,000 each excluding shipping and

handling

(Enter your tax due on all nonbusiness‑related purchases where the price of each item or service was

............................................................................................

1

under $1,000 from line 3 of Worksheet 1 below.)

2 Tax due on nonbusiness-related items or services costing $1,000 or more each

(from line 1 of

2

...............................................................................................................................

Worksheet 2 on page 2)

3 Tax due on Schedule C, Schedule C-EZ, or Schedule F business-related purchases, or

Schedule E (Part I), royalty or rental real estate related purchases

.

3

(from line 3 of Worksheet 3 on page 3)

4 Total sales or use tax due

Attach check or money order

(add lines 1, 2, and 3).

payable to: New York State Sales Tax ....................................................................................................

4

Worksheet 1 — Exact calculation of tax due for nonbusiness-related purchases costing less than $1,000 each.

Use this worksheet for nonbusiness-related purchases where the items or services cost less than $1,000 each, excluding shipping and handling.

However, the shipping and handling charges must be included in column A of Part 1 and Part II when computing your tax due. Therefore, the

total purchase price may exceed $110 (for the period January 1, 2011, through March 31, 2011), or $55 (on or after April 1, 2011) in column A of

Part 1, and $1,000 in column A of Part II when the shipping and handling charges are included.

Part 1 — Purchases of clothing and footwear eligible for exemption from New York State and some local sales and

use taxes.

For the period January 1, 2011, through March 31, 2011, purchases of clothing and footwear, excluding shipping and handling, costing less

than $110 are subject to the 4% New York State (NYS) sales and use tax, the d% tax in the Metropolitan Commuter Transportation District

(MCTD) (if applicable), and local sales tax in some localities. Use Chart 2 in the instructions to determine the appropriate tax rate to enter for

your locality in column B below on all purchases of clothing and footwear costing less than $110 per item if tax is due.

Starting April 1, 2011, purchases of clothing and footwear costing less than $55, excluding shipping and handling, are exempt from the 4% NYS

sales tax, the d% tax in the MCTD (if applicable), and some local taxes. If the locality where you reside chose not to provide the clothing and

footwear exemption, the local portion of the tax still applies.

Purchases in localities that elected to exempt purchases of qualifying clothing and footwear costing at least $55 but less than $110 from their

local sales tax are subject to the 4% NYS sales tax and the d% tax in the MCTD. Use Chart 3 in the instructions to determine the appropriate

tax rate to enter for your locality in column B below on all purchases of clothing and footwear starting April 1, 2011.

For fully taxable clothing and footwear purchases and for purchases of all other taxable items and services costing less than $1,000 per item or

service, excluding shipping and handling, you must also complete Part II below.

A

B

C

D

E

Purchase price

Your sales and

Tax

Tax paid to another

Tax due

use tax rate

taxing jurisdiction, if any

(see instructions)

(multiply column A

(subtract column D from

(from Charts 2 or 3;

by column B)

(see instructions)

column C; do not

see instructions)

enter less than zero)

1 Total

1.

.......................................

(add the Part I, column E amounts; do not enter less than zero)

(continued)

For office use only

Mail this return and remittance to:

NYS TAX DEPARTMENT

TRANSACTIoN DESk AUDIT BUREAU — CASUAL SALES UNIT

W A HARRIMAN CAMPUS

ALBANY NY 12227

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3