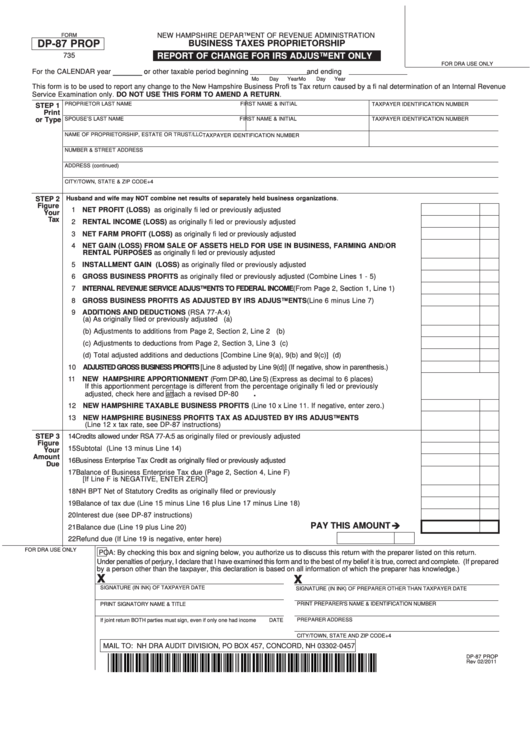

NEW HAMPSHIRE DEPARTMENT OF REVENUE ADMINISTRATION

FORM

DP-87 PROP

BUSINESS TAXES PROPRIETORSHIP

735

REPORT OF CHANGE FOR IRS ADJUSTMENT ONLY

FOR DRA USE ONLY

_____

For the CALENDAR year

or other taxable period beginning

and ending

Mo

Day

Year

Mo

Day

Year

This form is to be used to report any change to the New Hampshire Business Profi ts Tax return caused by a fi nal determination of an Internal Revenue

Service Examination only. DO NOT USE THIS FORM TO AMEND A RETURN.

PROPRIETOR LAST NAME

FIRST NAME & INITIAL

TAXPAYER IDENTIFICATION NUMBER

STEP 1

Print

or Type

SPOUSE’S LAST NAME

FIRST NAME & INITIAL

TAXPAYER IDENTIFICATION NUMBER

NAME OF PROPRIETORSHIP, ESTATE OR TRUST/LLC

TAXPAYER IDENTIFICATION NUMBER

NUMBER & STREET ADDRESS

ADDRESS (continued)

CITY/TOWN, STATE & ZIP CODE+4

Husband and wife may NOT combine net results of separately held business organizations.

STEP 2

Figure

1 NET PROFIT (LOSS) as originally fi led or previously adjusted ..................................................................1

Your

Tax

2 RENTAL INCOME (LOSS) as originally fi led or previously adjusted ...........................................................2

3 NET FARM PROFIT (LOSS) as originally fi led or previously adjusted ..........................................................3

4 NET GAIN (LOSS) FROM SALE OF ASSETS HELD FOR USE IN BUSINESS, FARMING AND/OR

RENTAL PURPOSES as originally fi led or previously adjusted .....................................................................4

5 INSTALLMENT GAIN (LOSS) as originally fi led or previously adjusted ....................................................5

6 GROSS BUSINESS PROFITS as originally fi led or previously adjusted (Combine Lines 1 - 5) .................6

7 INTERNAL REVENUE SERVICE ADJUSTMENTS TO FEDERAL INCOME (From Page 2, Section 1, Line 1) .....7

8 GROSS BUSINESS PROFITS AS ADJUSTED BY IRS ADJUSTMENTS (Line 6 minus Line 7) ............. 8

9 ADDITIONS AND DEDUCTIONS (RSA 77-A:4)

(a) As originally fi led or previously adjusted ......................................................................................... 9(a)

(b) Adjustments to additions from Page 2, Section 2, Line 2 ................................................................ 9(b)

(c) Adjustments to deductions from Page 2, Section 3, Line 3 .............................................................. 9(c)

(d) Total adjusted additions and deductions [Combine Line 9(a), 9(b) and 9(c)] ................................... 9(d)

10 ADJUSTED GROSS BUSINESS PROFITS [Line 8 adjusted by Line 9(d)] (If negative, show in parenthesis.) .......... 10

11 NEW HAMPSHIRE APPORTIONMENT (Form DP-80, Line 5) (Express as decimal to 6 places)

If this apportionment percentage is different from the percentage originally fi led or previously

.

adjusted, check here

and attach a revised DP-80 ........................................................................ 11

12 NEW HAMPSHIRE TAXABLE BUSINESS PROFITS (Line 10 x Line 11. If negative, enter zero.) ........... 12

13 NEW HAMPSHIRE BUSINESS PROFITS TAX AS ADJUSTED BY IRS ADJUSTMENTS .................... 13

(Line 12 x tax rate, see DP-87 instructions)

STEP 3

14 Credits allowed under RSA 77-A:5 as originally fi led or previously adjusted ................................................. 14

Figure

15 Subtotal (Line 13 minus Line 14) ............................................................................................................. 15

Your

Amount

16 Business Enterprise Tax Credit as originally fi led or previously adjusted ................................................................ 16

Due

17 Balance of Business Enterprise Tax due (Page 2, Section 4, Line F)

[If Line F is NEGATIVE, ENTER ZERO] .................................................................................................... 17

18 NH BPT Net of Statutory Credits as originally fi led or previously adjusted................................................ 18

19 Balance of tax due (Line 15 minus Line 16 plus Line 17 minus Line 18) .................................................. 19

20 Interest due (see DP-87 instructions) ........................................................................................................ 20

PAY THIS AMOUNT

21 Balance due (Line 19 plus Line 20) ........................................................................................................... 21

22 Refund due (If Line 19 is negative, enter here) .............................................. 22

FOR DRA USE ONLY

POA: By checking this box and signing below, you authorize us to discuss this return with the preparer listed on this return.

Under penalties of perjury, I declare that I have examined this form and to the best of my belief it is true, correct and complete. (If prepared

by a person other than the taxpayer, this declaration is based on all information of which the preparer has knowledge.)

x

x

SIGNATURE (IN INK) OF TAXPAYER

DATE

SIGNATURE (IN INK) OF PREPARER OTHER THAN TAXPAYER

DATE

PRINT SIGNATORY NAME & TITLE

PRINT PREPARER'S NAME & IDENTIFICATION NUMBER

PREPARER ADDRESS

If joint return BOTH parties must sign, even if only one had income

DATE

CITY/TOWN, STATE AND ZIP CODE+4

MAIL TO: NH DRA AUDIT DIVISION, PO BOX 457, CONCORD, NH 03302-0457

DP-87 PROP

Rev 02/2011

1

1 2

2