*AP20630W041506*

AP-206-3

PRINT FORM

CLEAR FIELDS

(Rev.4-15/6)

*AP20630W041506*

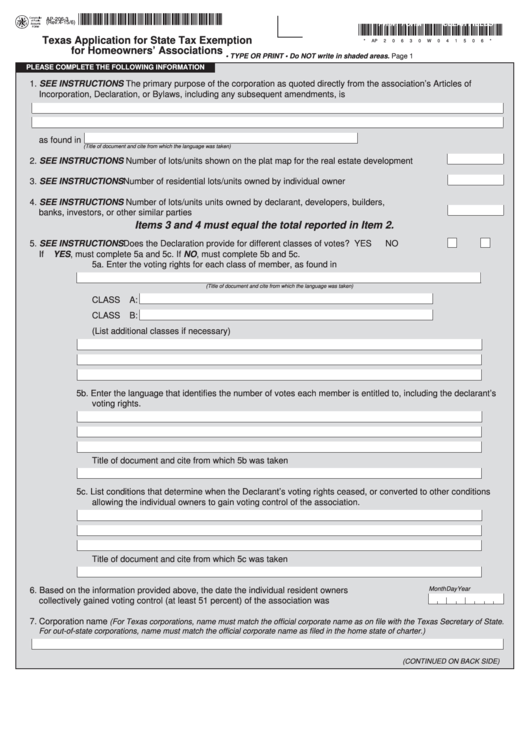

Texas Application for State Tax Exemption

*

A

P

2

0

6

3

0

W

0

4

1

5

0

6

*

for Homeowners’ Associations

• TYPE OR PRINT

• Do NOT write in shaded areas.

Page 1

PLEASE COMPLETE THE FOLLOWING INFORMATION

1. SEE INSTRUCTIONS The primary purpose of the corporation as quoted directly from the association’s Articles of

Incorporation, Declaration, or Bylaws, including any subsequent amendments, is

as found in

(Title of document and cite from which the language was taken)

2. SEE INSTRUCTIONS Number of lots/units shown on the plat map for the real estate development ...........

3. SEE INSTRUCTIONS Number of residential lots/units owned by individual owner ......................................

4. SEE INSTRUCTIONS Number of lots/units units owned by declarant, developers, builders,

banks, investors, or other similar parties ......................................................................................................

Items 3 and 4 must equal the total reported in Item 2.

5. SEE INSTRUCTIONS Does the Declaration provide for different classes of votes? ....................................

YES

NO

If YES, must complete 5a and 5c. If NO, must complete 5b and 5c.

5a. Enter the voting rights for each class of member, as found in

(Title of document and cite from which the language was taken)

CLASS A:

CLASS B:

(List additional classes if necessary)

5b. Enter the language that identifies the number of votes each member is entitled to, including the declarant’s

voting rights.

Title of document and cite from which 5b was taken

5c. List conditions that determine when the Declarant’s voting rights ceased, or converted to other conditions

allowing the individual owners to gain voting control of the association.

Title of document and cite from which 5c was taken

Month Day

Year

6. Based on the information provided above, the date the individual resident owners

collectively gained voting control (at least 51 percent) of the association was ........................................

7. Corporation name

(For Texas corporations, name must match the official corporate name as on file with the Texas Secretary of State.

For out-of-state corporations, name must match the official corporate name as filed in the home state of charter.)

(CONTINUED ON BACK SIDE)

1

1 2

2