Instructions For Beneficiary Filing Form 1040 - Internal Revenue Service, Tax Products Coordinating Committee Of Washington - 2007

ADVERTISEMENT

3

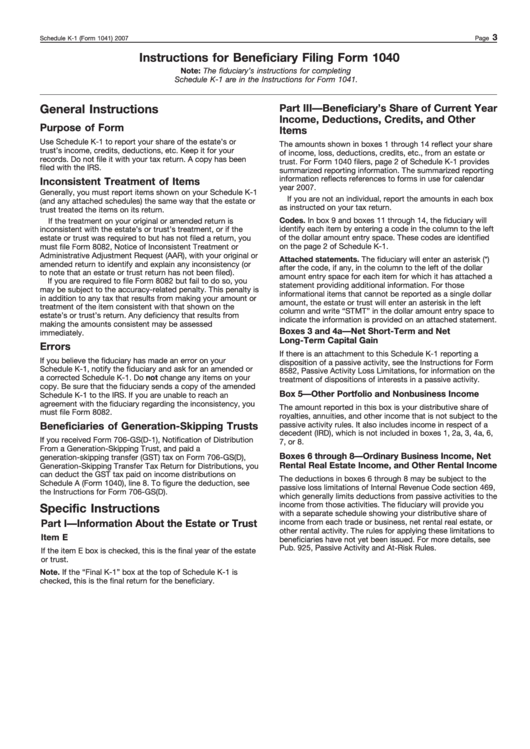

Schedule K-1 (Form 1041) 2007

Page

Instructions for Beneficiary Filing Form 1040

Note: The fiduciary’s instructions for completing

Schedule K-1 are in the Instructions for Form 1041.

General Instructions

Part III—Beneficiary’s Share of Current Year

Income, Deductions, Credits, and Other

Purpose of Form

Items

Use Schedule K-1 to report your share of the estate’s or

The amounts shown in boxes 1 through 14 reflect your share

trust’s income, credits, deductions, etc. Keep it for your

of income, loss, deductions, credits, etc., from an estate or

records. Do not file it with your tax return. A copy has been

trust. For Form 1040 filers, page 2 of Schedule K-1 provides

filed with the IRS.

summarized reporting information. The summarized reporting

information reflects references to forms in use for calendar

Inconsistent Treatment of Items

year 2007.

Generally, you must report items shown on your Schedule K-1

If you are not an individual, report the amounts in each box

(and any attached schedules) the same way that the estate or

as instructed on your tax return.

trust treated the items on its return.

Codes. In box 9 and boxes 11 through 14, the fiduciary will

If the treatment on your original or amended return is

identify each item by entering a code in the column to the left

inconsistent with the estate’s or trust’s treatment, or if the

of the dollar amount entry space. These codes are identified

estate or trust was required to but has not filed a return, you

on the page 2 of Schedule K-1.

must file Form 8082, Notice of Inconsistent Treatment or

Administrative Adjustment Request (AAR), with your original or

Attached statements. The fiduciary will enter an asterisk (*)

amended return to identify and explain any inconsistency (or

after the code, if any, in the column to the left of the dollar

to note that an estate or trust return has not been filed).

amount entry space for each item for which it has attached a

If you are required to file Form 8082 but fail to do so, you

statement providing additional information. For those

may be subject to the accuracy-related penalty. This penalty is

informational items that cannot be reported as a single dollar

in addition to any tax that results from making your amount or

amount, the estate or trust will enter an asterisk in the left

treatment of the item consistent with that shown on the

column and write “STMT” in the dollar amount entry space to

estate’s or trust’s return. Any deficiency that results from

indicate the information is provided on an attached statement.

making the amounts consistent may be assessed

Boxes 3 and 4a—Net Short-Term and Net

immediately.

Long-Term Capital Gain

Errors

If there is an attachment to this Schedule K-1 reporting a

If you believe the fiduciary has made an error on your

disposition of a passive activity, see the Instructions for Form

Schedule K-1, notify the fiduciary and ask for an amended or

8582, Passive Activity Loss Limitations, for information on the

a corrected Schedule K-1. Do not change any items on your

treatment of dispositions of interests in a passive activity.

copy. Be sure that the fiduciary sends a copy of the amended

Box 5—Other Portfolio and Nonbusiness Income

Schedule K-1 to the IRS. If you are unable to reach an

agreement with the fiduciary regarding the inconsistency, you

The amount reported in this box is your distributive share of

must file Form 8082.

royalties, annuities, and other income that is not subject to the

passive activity rules. It also includes income in respect of a

Beneficiaries of Generation-Skipping Trusts

decedent (IRD), which is not included in boxes 1, 2a, 3, 4a, 6,

If you received Form 706-GS(D-1), Notification of Distribution

7, or 8.

From a Generation-Skipping Trust, and paid a

Boxes 6 through 8—Ordinary Business Income, Net

generation-skipping transfer (GST) tax on Form 706-GS(D),

Rental Real Estate Income, and Other Rental Income

Generation-Skipping Transfer Tax Return for Distributions, you

can deduct the GST tax paid on income distributions on

The deductions in boxes 6 through 8 may be subject to the

Schedule A (Form 1040), line 8. To figure the deduction, see

passive loss limitations of Internal Revenue Code section 469,

the Instructions for Form 706-GS(D).

which generally limits deductions from passive activities to the

income from those activities. The fiduciary will provide you

Specific Instructions

with a separate schedule showing your distributive share of

income from each trade or business, net rental real estate, or

Part I—Information About the Estate or Trust

other rental activity. The rules for applying these limitations to

Item E

beneficiaries have not yet been issued. For more details, see

Pub. 925, Passive Activity and At-Risk Rules.

If the item E box is checked, this is the final year of the estate

or trust.

Note. If the “Final K-1” box at the top of Schedule K-1 is

checked, this is the final return for the beneficiary.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7