Form A-213 - Corporation Schedule A - Petition For Compromise Of Taxes

ADVERTISEMENT

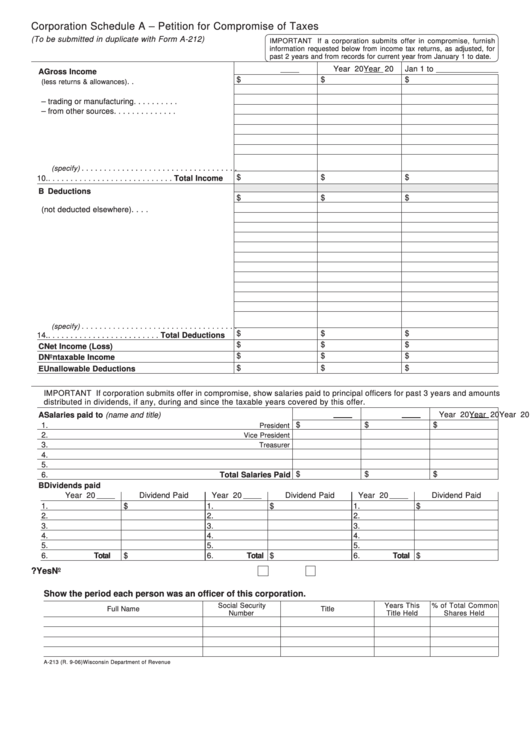

Corporation Schedule A – Petition for Compromise of Taxes

(To be submitted in duplicate with Form A-212)

IMPORTANT If a corporation submits offer in compromise, furnish

information requested below from income tax returns, as adjusted, for

1. Statement of Income

past 2 years and from records for current year from January 1 to date.

Year 20

Year 20

Jan 1 to

A Gross Income

$

$

$

1. Gross sales or receipts

. .

(less returns & allowances)

2. Cost of goods sold . . . . . . . . . . . . . . . . . . . . . . . . . .

3. Gross profit – trading or manufacturing . . . . . . . . . .

4. Gross profit – from other sources . . . . . . . . . . . . . .

5. Interest income . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6. Rents and royalties . . . . . . . . . . . . . . . . . . . . . . . . . .

7. Gains and losses . . . . . . . . . . . . . . . . . . . . . . . . . . .

8. Dividends . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

9. Other income

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

(specify)

$

$

$

10. . . . . . . . . . . . . . . . . . . . . . . . . . . . . Total Income

B Deductions

$

$

$

1. Compensation of officers . . . . . . . . . . . . . . . . . . . . .

2. Salaries and wages (not deducted elsewhere) . . . .

3. Rents . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4. Repairs . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5. Bad debt . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6. Interest . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7. Taxes . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

8. Losses . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

9. Dividends . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

10. Depreciation and depletion . . . . . . . . . . . . . . . . . . .

11. Contributions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

12. Advertising . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

13. Other deductions

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

(specify)

$

$

$

14. . . . . . . . . . . . . . . . . . . . . . . . . . Total Deductions

$

$

$

C Net Income (Loss)

$

$

$

D Nontaxable Income

$

$

$

E Unallowable Deductions

2. Salaries Paid to Principal Officers and Dividends Distributed

IMPORTANT If corporation submits offer in compromise, show salaries paid to principal officers for past 3 years and amounts

distributed in dividends, if any, during and since the taxable years covered by this offer.

Year 20

Year 20

Year 20

A Salaries paid to (name and title)

1.

$

$

$

President

2.

Vice President

3.

Treasurer

4.

5.

$

$

$

6.

Total Salaries Paid

B Dividends paid

Year 20

Dividend Paid

Year 20

Dividend Paid

Year 20

Dividend Paid

1.

$

1.

$

1.

$

2.

2.

2.

3.

3.

3.

4.

4.

4.

5.

5.

5.

6.

$

6.

$

6.

$

Total

Total

Total

3. Is this corporation in process of liquidation?

Yes

No

4. List principal officers from the beginning of the taxable period covered by this compromise to the present time.

Show the period each person was an officer of this corporation.

Social Security

Years This

% of Total Common

Full Name

Title

Number

Title Held

Shares Held

A-213 (R. 9-06)

Wisconsin Department of Revenue

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1