Form Rc-6-A - Instructions

ADVERTISEMENT

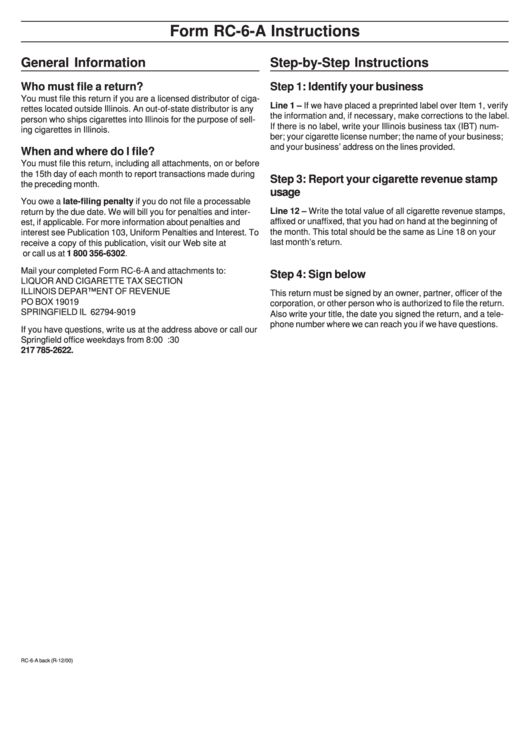

Form RC-6-A Instructions

General Information

Step-by-Step Instructions

Who must file a return?

Step 1: Identify your business

You must file this return if you are a licensed distributor of ciga-

Line 1 – If we have placed a preprinted label over Item 1, verify

rettes located outside Illinois. An out-of-state distributor is any

the information and, if necessary, make corrections to the label.

person who ships cigarettes into Illinois for the purpose of sell-

If there is no label, write your Illinois business tax (IBT) num-

ing cigarettes in Illinois.

ber; your cigarette license number; the name of your business;

and your business’ address on the lines provided.

When and where do I file?

You must file this return, including all attachments, on or before

the 15th day of each month to report transactions made during

Step 3: Report your cigarette revenue stamp

the preceding month.

usage

You owe a late-filing penalty if you do not file a processable

Line 12 – Write the total value of all cigarette revenue stamps,

return by the due date. We will bill you for penalties and inter-

affixed or unaffixed, that you had on hand at the beginning of

est, if applicable. For more information about penalties and

the month. This total should be the same as Line 18 on your

interest see Publication 103, Uniform Penalties and Interest. To

last month’s return.

receive a copy of this publication, visit our Web site at

or call us at 1 800 356-6302.

Mail your completed Form RC-6-A and attachments to:

Step 4: Sign below

LIQUOR AND CIGARETTE TAX SECTION

ILLINOIS DEPARTMENT OF REVENUE

This return must be signed by an owner, partner, officer of the

PO BOX 19019

corporation, or other person who is authorized to file the return.

SPRINGFIELD IL 62794-9019

Also write your title, the date you signed the return, and a tele-

phone number where we can reach you if we have questions.

If you have questions, write us at the address above or call our

Springfield office weekdays from 8:00 a.m. to 4:30 p.m. at

217 785-2622.

RC-6-A back (R-12/00)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1