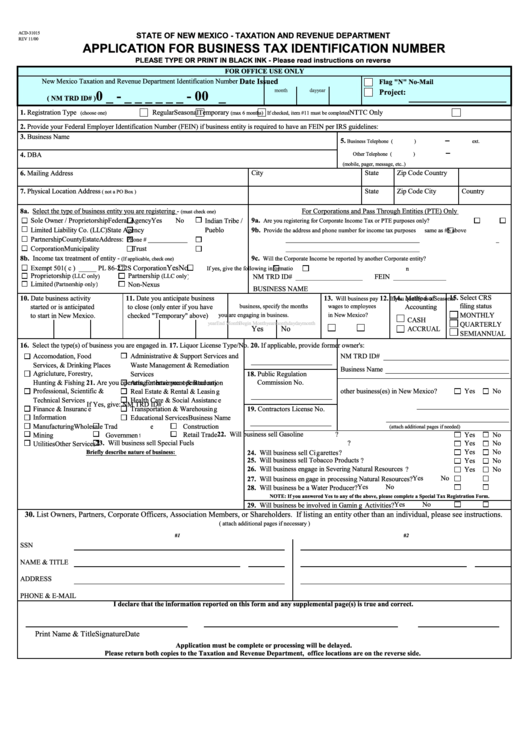

Form Acd-31015 - Application For Business Tax Identification Number - Nm Taxation And Revenue Department - 2000

ADVERTISEMENT

ACD-31015

STATE OF NEW MEXICO - TAXATION AND REVENUE DEPARTMENT

REV 11/00

APPLICATION FOR BUSINESS TAX IDENTIFICATION NUMBER

PLEASE TYPE OR PRINT IN BLACK INK - Please read instructions on reverse

FOR OFFICE USE ONLY

New Mexico Taxation and Revenue Department Identification Number

Date Issued

Flag "N" No-Mail

month

day

year

Project:

0 _ - _ _ _ _ _ _ - 00 _

( NM TRD ID# )

1. Registration Type

Regular

Seasonal

Temporary

NTTC Only

(choose one)

(max 6 months) If checked, item #11 must be completed

2. Provide your Federal Employer Identification Number (FEIN) if business entity is required to have an FEIN per IRS guidelines:

3. Business Name

5.

Business Telephone (

)

ext.

4. DBA

Other Telephone (

)

(mobile, pager, message, etc..)

City

State

Zip Code

Country

6. Mailing Address

7. Physical Location Address

City

State

Zip Code

Country

( not a PO Box )

8a. Select the type of business entity you are registering -

For Corporations and Pass Through Entities (PTE) Only

(must check one)

Sole Owner / Proprietorship

Federal Agency

9a.

Indian Tribe /

Yes

No

Are you registering for Corporate Income Tax or PTE purposes only?

Limited Liability Co. (LLC)

State Agency

Pueblo

9b.

Provide the address and phone number for income tax purposes

same as #6 above

Partnership

County

Estate

Address:

____________________________________________

Phone # ______________

Corporation

Municipality

Trust

____________________________________________

8b. Income tax treatment of entity -

9c.

Will the Corporate Income be reported by another Corporate entity?

(If applicable, check one)

Yes

No

Exempt 501( c ) _____

PL 86-272

S Corporation

If yes, give the following information

Proprietorship

Partnership

(LLC only)

(LLC only)

NM TRD ID# ___________________

FEIN _______________

Limited

Non-Nexus

(Partnership only)

BUSINESS NAME

15. Select CRS

10. Date business activity

11. Date you anticipate business

12.

13.

14. Method of

If you qualify as a Seasonal

Will business pay

filing status

started or is anticipated

to close (only enter if you have

business, specify the months

wages to employees

Accounting

to start in New Mexico.

checked "Temporary" above)

you are engaging in business.

in New Mexico?

MONTHLY

CASH

month

day

year

month

day

year

Begin Month

End Month

QUARTERLY

Yes

No

ACCRUAL

SEMIANNUAL

16. Select the type(s) of business you are engaged in.

17. Liquor License Type/No.

20. If applicable, provide former owner's:

Administrative & Support Services and

Accomodation, Food

NM TRD ID#

Services, & Drinking Places

Waste Management & Remediation

Business Name

Agricluture, Forestry,

18. Public Regulation

Services

Hunting & Fishing

Arts, Entertainment & Recreation

Commission No.

21. Are you operating or have you operated any

Professional, Scientific &

other business(es) in New Mexico?

Yes

No

Real Estate & Rental & Leasing

Technical Services

Health Care & Social Assistance

If Yes, give: NM TRD ID#

Finance & Insurance

Transportation & Warehousing

19. Contractors License No.

Information

Educational Services

Business Name

Manufacturing

Wholesale Trade

Construction

(attach additional pages if needed)

Retail Trade

22. Will business sell Gasoline?

Yes

No

Mining

Government

23. Will business sell Special Fuels?

Yes

No

Utilities

Other Services

Yes

No

Briefly describe nature of business:

24. Will business sell Cigarettes?

25. Will business sell Tobacco Products?

Yes

No

26. Will business engage in Severing Natural Resources?

Yes

No

Yes

No

27. Will business engage in processing Natural Resources?

Yes

No

28. Will business be a Water Producer?

NOTE: If you answered Yes to any of the above, please complete a Special Tax Registration Form.

Yes

No

29. Will business be involved in Gaming Activities?

30. List Owners, Partners, Corporate Officers, Association Members, or Shareholders. If listing an entity other than an individual, please see instructions.

( attach additional pages if necessary )

#1

#2

SSN

NAME & TITLE

ADDRESS

PHONE & E-MAIL

I declare that the information reported on this form and any supplemental page(s) is true and correct.

Print Name & Title

Signature

Date

Application must be complete or processing will be delayed.

Please return both copies to the Taxation and Revenue Department, office locations are on the reverse side.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1