Form A-101 - North Carolina Estate Tax Return Form

ADVERTISEMENT

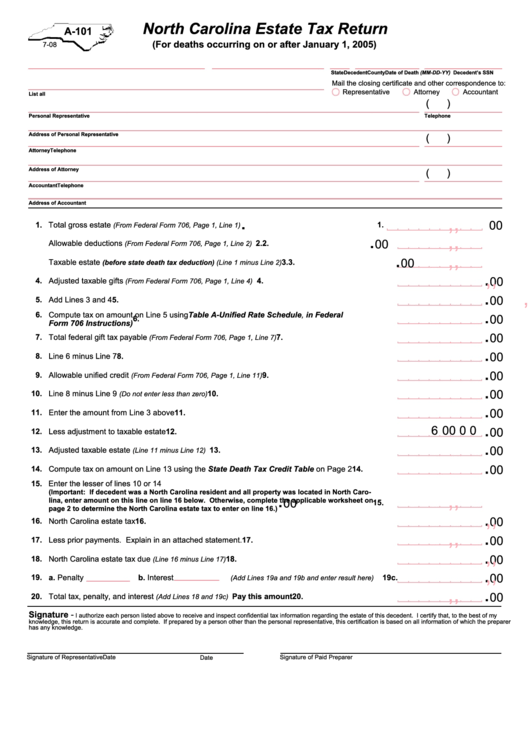

North Carolina Estate Tax Return

A-101

(For deaths occurring on or after January 1, 2005)

7-08

Decedent

County

State

Date of Death (MM-DD-YY) Decedent’s SSN

Mail the closing certificate and other correspondence to:

Representative

Attorney

Accountant

List all N.C. counties in which decedent owned real estate

(

)

Personal Representative

Telephone

Address of Personal Representative

(

)

Attorney

Telephone

Address of Attorney

(

)

Accountant

Telephone

Address of Accountant

.

,

,

00

1. Total gross estate

1.

(From Federal Form 706, Page 1, Line 1)

.

,

,

00

2.

2.

Allowable deductions

(From Federal Form 706, Page 1, Line 2)

.

,

,

00

3.

Taxable estate

3.

(before state death tax deduction) (Line 1 minus Line 2)

.

,

,

00

4.

Adjusted taxable gifts

4.

(From Federal Form 706, Page 1, Line 4)

,

,

.

00

5.

Add Lines 3 and 4

5.

,

,

.

6.

Compute tax on amount on Line 5 using Table A-Unified Rate Schedule, in Federal

00

6.

Form 706 Instructions)

.

,

,

00

7.

Total federal gift tax payable

7.

(From Federal Form 706, Page 1, Line 7)

.

,

,

00

8.

Line 6 minus Line 7

8.

.

,

,

00

9.

Allowable unified credit

9.

(From Federal Form 706, Page 1, Line 11)

.

,

,

00

10.

Line 8 minus Line 9

10.

(Do not enter less than zero)

.

,

,

00

11.

Enter the amount from Line 3 above

11.

.

,

,

6 0 0 0 0

00

12.

Less adjustment to taxable estate

12.

.

,

,

00

13.

Adjusted taxable estate

13.

(Line 11 minus Line 12)

.

,

,

00

14.

14.

Compute tax on amount on Line 13 using the State Death Tax Credit Table on Page 2

15. Enter the lesser of lines 10 or 14

,

,

.

(Important: If decedent was a North Carolina resident and all property was located in North Caro-

lina, enter amount on this line on line 16 below. Otherwise, complete the applicable worksheet on

00

15.

page 2 to determine the North Carolina estate tax to enter on line 16.)

,

,

.

00

16.

North Carolina estate tax

16.

.

,

,

00

17.

Less prior payments. Explain in an attached statement.

17.

.

,

,

00

18.

North Carolina estate tax due

18.

(Line 16 minus Line 17)

.

,

,

00

19.

a. Penalty

b. Interest

19c.

(Add Lines 19a and 19b and enter result here)

.

,

,

00

20.

Total tax, penalty, and interest

Pay this amount

20.

(Add Lines 18 and 19c)

Signature -

I authorize each person listed above to receive and inspect confidential tax information regarding the estate of this decedent. I certify that, to the best of my

knowledge, this return is accurate and complete. If prepared by a person other than the personal representative, this certification is based on all information of which the preparer

has any knowledge.

Signature of Representative

Signature of Paid Preparer

Date

Date

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1