Form E-500e - Electricity And Telecommunications

ADVERTISEMENT

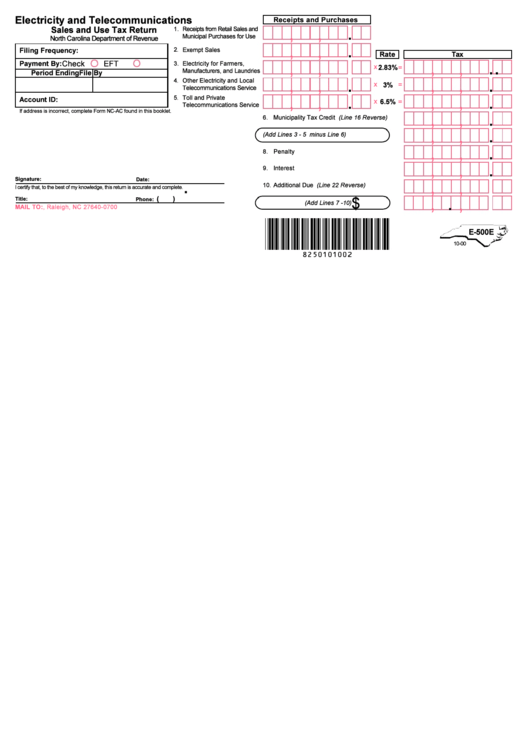

Electricity and Telecommunications

Receipts and Purchases

.

,

,

Sales and Use Tax Return

1.

Receipts from Retail Sales and

Municipal Purchases for Use

North Carolina Department of Revenue

.

,

,

2

Exempt Sales

Filing Frequency:

.

Rate

Tax

.

.

,

,

,

,

Check

EFT

Payment By:

3.

Electricity for Farmers,

x

2.83%

=

Manufacturers, and Laundries

Period Ending

File By

.

.

,

,

,

,

4

Other Electricity and Local

.

x

=

3%

Telecommunications Service

.

.

,

,

,

,

5

Toll and Private

Account ID:

.

x

6.5%

=

Telecommunications Service

.

If address is incorrect, complete Form NC-AC found in this booklet.

,

,

6.

Municipality Tax Credit (Line 16 Reverse)

.

,

,

7. Tax Due (Add Lines 3 - 5 minus Line 6)

.

,

,

8.

Penalty

.

,

,

9.

Interest

.

Signature:

Date:

,

,

10.

Additional Due (Line 22 Reverse)

I certify that, to the best of my knowledge, this return is accurate and complete.

.

$

,

,

(

)

Title:

Phone:

11. Total Due

(Add Lines 7 -10)

MAIL TO: P.O. Box 25000, Raleigh, NC 27640-0700

E-500E

10-00

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2