BOE-400-TPA (S1F) REV. 2 (5-07)

STATE OF CALIFORNIA

TRADING PARTNER AGREEMENT

BOARD OF EQUALIZATION

FOR BOE MOTOR FUELS ELECTRONIC FILING PROGRAM

This agreement is entered into by and between the State of California, Board of Equalization’s Fuel Taxes Division, hereinafter “the BOE,”

and

INFORMATION PROVIDER NAME

DBA (if used in this state)

MAILING ADDRESS (city, state, zip code)

FEDERAL EMPLOYER IDENTIFICATION NUMBER (FEIN)

hereinafter “the Taxpayer.”

The BOE and the Taxpayer wish to provide a means by which the Taxpayer will file tax forms by electronically transmitting data in

substitution for conventional, paper-based documents and to assure that such tax forms are legally valid and enforceable.

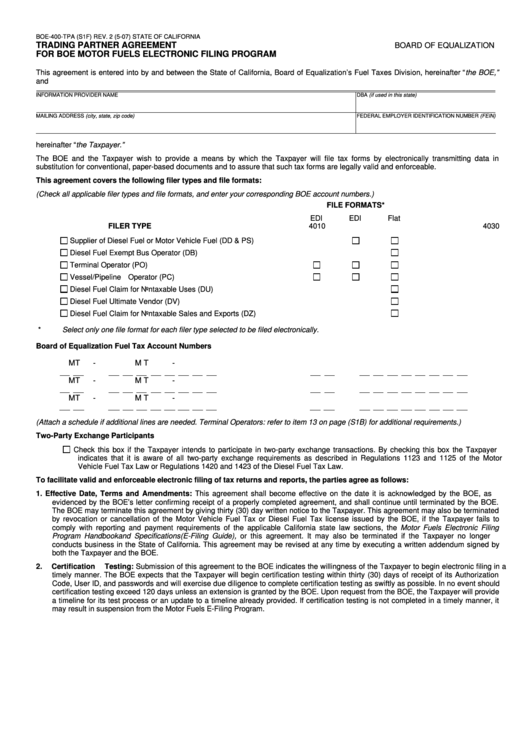

This agreement covers the following filer types and file formats:

(Check all applicable filer types and file formats, and enter your corresponding BOE account numbers.)

FILE FORMATS*

EDI

EDI

Flat

FILER TYPE

4010

4030

File

Supplier of Diesel Fuel or Motor Vehicle Fuel (DD & PS)

Diesel Fuel Exempt Bus Operator (DB)

Terminal Operator (PO)

Vessel/Pipeline Operator (PC)

Diesel Fuel Claim for Nontaxable Uses (DU)

Diesel Fuel Ultimate Vendor (DV)

Diesel Fuel Claim for Nontaxable Sales and Exports (DZ)

*Select only one file format for each filer type selected to be filed electronically.

Board of Equalization Fuel Tax Account Numbers

MT

-

MT

-

MT

-

MT

-

MT

-

MT

-

(Attach a schedule if additional lines are needed. Terminal Operators: refer to item 13 on page (S1B) for additional requirements.)

Two-Party Exchange Participants

Check this box if the Taxpayer intends to participate in two-party exchange transactions. By checking this box the Taxpayer

indicates that it is aware of all two-party exchange requirements as described in Regulations 1123 and 1125 of the Motor

Vehicle Fuel Tax Law or Regulations 1420 and 1423 of the Diesel Fuel Tax Law.

To facilitate valid and enforceable electronic filing of tax returns and reports, the parties agree as follows:

1.

Effective Date, Terms and Amendments: This agreement shall become effective on the date it is acknowledged by the BOE, as

evidenced by the BOE’s letter confirming receipt of a properly completed agreement, and shall continue until terminated by the BOE.

The BOE may terminate this agreement by giving thirty (30) day written notice to the Taxpayer. This agreement may also be terminated

by revocation or cancellation of the Motor Vehicle Fuel Tax or Diesel Fuel Tax license issued by the BOE, if the Taxpayer fails to

comply with reporting and payment requirements of the applicable California state law sections, the Motor Fuels Electronic Filing

Program Handbook and Specifications (E-Filing Guide), or this agreement. It may also be terminated if the Taxpayer no longer

conducts business in the State of California. This agreement may be revised at any time by executing a written addendum signed by

both the Taxpayer and the BOE.

2.

Certification Testing: Submission of this agreement to the BOE indicates the willingness of the Taxpayer to begin electronic filing in a

timely manner. The BOE expects that the Taxpayer will begin certification testing within thirty (30) days of receipt of its Authorization

Code, User ID, and passwords and will exercise due diligence to complete certification testing as swiftly as possible. In no event should

certification testing exceed 120 days unless an extension is granted by the BOE. Upon request from the BOE, the Taxpayer will provide

a timeline for its test process or an update to a timeline already provided. If certification testing is not completed in a timely manner, it

may result in suspension from the Motor Fuels E-Filing Program.

Continued

1

1 2

2 3

3 4

4