Form E-599h - North Carolina Sales Tax Holiday Exemption Certificate

ADVERTISEMENT

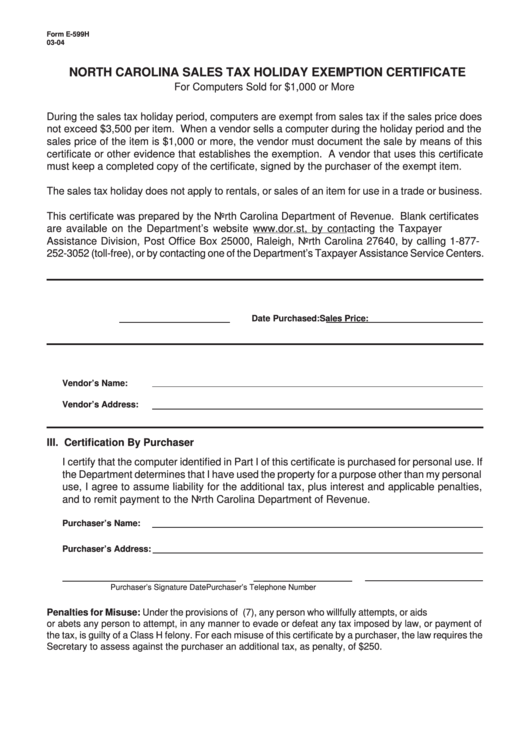

Form E-599H

03-04

NORTH CAROLINA SALES TAX HOLIDAY EXEMPTION CERTIFICATE

For Computers Sold for $1,000 or More

During the sales tax holiday period, computers are exempt from sales tax if the sales price does

not exceed $3,500 per item. When a vendor sells a computer during the holiday period and the

sales price of the item is $1,000 or more, the vendor must document the sale by means of this

certificate or other evidence that establishes the exemption. A vendor that uses this certificate

must keep a completed copy of the certificate, signed by the purchaser of the exempt item.

The sales tax holiday does not apply to rentals, or sales of an item for use in a trade or business.

This certificate was prepared by the North Carolina Department of Revenue. Blank certificates

are available on the Department’s website , by contacting the Taxpayer

Assistance Division, Post Office Box 25000, Raleigh, North Carolina 27640, by calling 1-877-

252-3052 (toll-free), or by contacting one of the Department’s Taxpayer Assistance Service Centers.

I. Computer Information

Sales Price:

Date Purchased:

II. Vendor Identification

Vendor’s Name:

Vendor’s Address:

III. Certification By Purchaser

I certify that the computer identified in Part I of this certificate is purchased for personal use. If

the Department determines that I have used the property for a purpose other than my personal

use, I agree to assume liability for the additional tax, plus interest and applicable penalties,

and to remit payment to the North Carolina Department of Revenue.

Purchaser’s Name:

Purchaser’s Address:

Purchaser’s Signature

Date

Purchaser’s Telephone Number

Penalties for Misuse: Under the provisions of G.S. 105-236(7), any person who willfully attempts, or aids

or abets any person to attempt, in any manner to evade or defeat any tax imposed by law, or payment of

the tax, is guilty of a Class H felony. For each misuse of this certificate by a purchaser, the law requires the

Secretary to assess against the purchaser an additional tax, as penalty, of $250.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1