Form 40f Instructions

ADVERTISEMENT

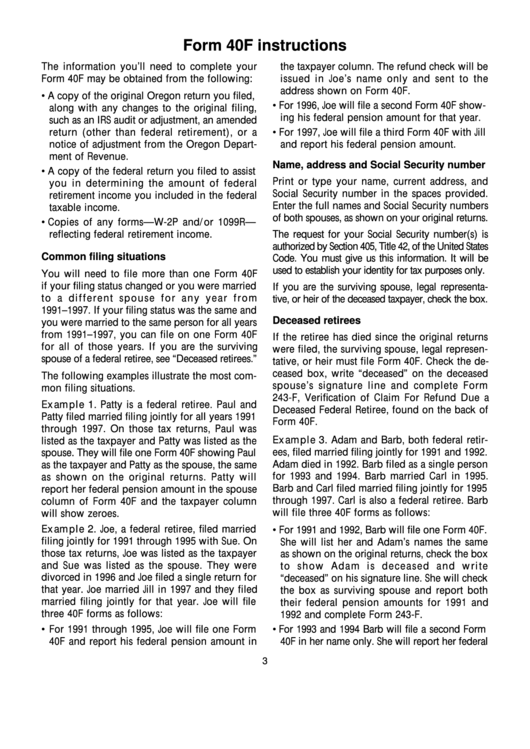

Form 40F instructions

The information you’ll need to complete your

the taxpayer column. The refund check will be

Form 40F may be obtained from the following:

issued in Joe’s name only and sent to the

address shown on Form 40F.

• A copy of the original Oregon return you filed,

• For 1996, Joe will file a second Form 40F show-

along with any changes to the original filing,

ing his federal pension amount for that year.

such as an IRS audit or adjustment, an amended

return (other than federal retirement), or a

• For 1997, Joe will file a third Form 40F with Jill

notice of adjustment from the Oregon Depart-

and report his federal pension amount.

ment of Revenue.

Name, address and Social Security number

• A copy of the federal return you filed to assist

Print or type your name, current address, and

you in determining the amount of federal

Social Security number in the spaces provided.

retirement income you included in the federal

Enter the full names and Social Security numbers

taxable income.

of both spouses, as shown on your original returns.

• Copies of any forms—W-2P and/or 1099R—

reflecting federal retirement income.

The request for your Social Security number(s) is

authorized by Section 405, Title 42, of the United States

Common filing situations

Code. You must give us this information. It will be

used to establish your identity for tax purposes only.

You will need to file more than one Form 40F

if your filing status changed or you were married

If you are the surviving spouse, legal representa-

to a different spouse for any year from

tive, or heir of the deceased taxpayer, check the box.

1991–1997. If your filing status was the same and

Deceased retirees

you were married to the same person for all years

from 1991–1997, you can file on one Form 40F

If the retiree has died since the original returns

for all of those years. If you are the surviving

were filed, the surviving spouse, legal represen-

spouse of a federal retiree, see “Deceased retirees.”

tative, or heir must file Form 40F. Check the de-

ceased box, write “deceased” on the deceased

The following examples illustrate the most com-

spouse’s signature line and complete Form

mon filing situations.

243-F, Verification of Claim For Refund Due a

Example 1. Patty is a federal retiree. Paul and

Deceased Federal Retiree, found on the back of

Patty filed married filing jointly for all years 1991

Form 40F.

through 1997. On those tax returns, Paul was

Example 3. Adam and Barb, both federal retir-

listed as the taxpayer and Patty was listed as the

ees, filed married filing jointly for 1991 and 1992.

spouse. They will file one Form 40F showing Paul

Adam died in 1992. Barb filed as a single person

as the taxpayer and Patty as the spouse, the same

for 1993 and 1994. Barb married Carl in 1995.

as shown on the original returns. Patty will

Barb and Carl filed married filing jointly for 1995

report her federal pension amount in the spouse

through 1997. Carl is also a federal retiree. Barb

column of Form 40F and the taxpayer column

will file three 40F forms as follows:

will show zeroes.

Example 2. Joe, a federal retiree, filed married

• For 1991 and 1992, Barb will file one Form 40F.

filing jointly for 1991 through 1995 with Sue. On

She will list her and Adam’s names the same

those tax returns, Joe was listed as the taxpayer

as shown on the original returns, check the box

and Sue was listed as the spouse. They were

to show Adam is deceased and write

divorced in 1996 and Joe filed a single return for

“deceased” on his signature line. She will check

that year. Joe married Jill in 1997 and they filed

the box as surviving spouse and report both

married filing jointly for that year. Joe will file

their federal pension amounts for 1991 and

three 40F forms as follows:

1992 and complete Form 243-F.

• For 1991 through 1995, Joe will file one Form

• For 1993 and 1994 Barb will file a second Form

40F and report his federal pension amount in

40F in her name only. She will report her federal

3

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2