Instructions For Rev-571 Schedule C-Sb

ADVERTISEMENT

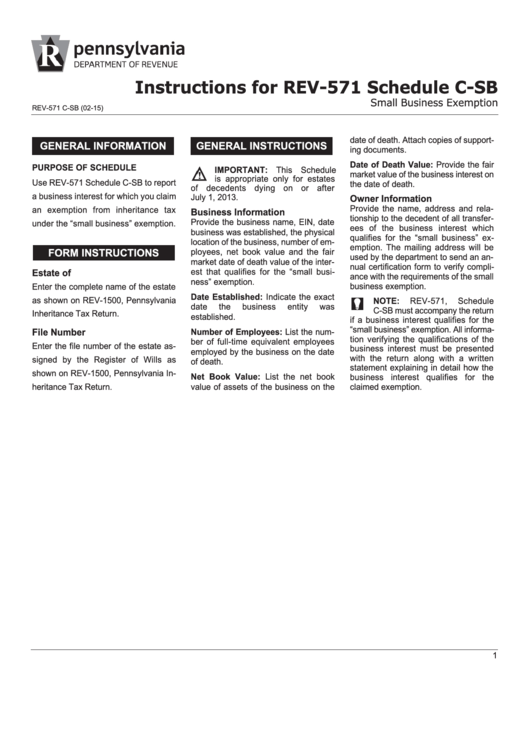

Instructions for REV-571 Schedule C-SB

Small Business Exemption

REV-571 C-SB (02-15)

date of death. Attach copies of support-

GENERAL INFORMATION

GENERAL INSTRUCTIONS

ing documents.

Date of Death Value: Provide the fair

PURPOSE OF SCHEDULE

IMPORTANT: This Schedule

market value of the business interest on

is appropriate only for estates

Use REV-571 Schedule C-SB to report

the date of death.

of decedents dying on or after

a business interest for which you claim

July 1, 2013.

Owner Information

Provide the name, address and rela-

an exemption from inheritance tax

Business Information

tionship to the decedent of all transfer-

Provide the business name, EIN, date

under the “small business” exemption.

ees of the business interest which

business was established, the physical

qualifies for the “small business” ex-

location of the business, number of em-

emption. The mailing address will be

ployees, net book value and the fair

FORM INSTRUCTIONS

used by the department to send an an-

market date of death value of the inter-

nual certification form to verify compli-

est that qualifies for the “small busi-

Estate of

ance with the requirements of the small

ness” exemption.

business exemption.

Enter the complete name of the estate

Date Established: Indicate the exact

as shown on REV-1500, Pennsylvania

NOTE:

REV-571,

Schedule

date

the

business

entity

was

C-SB must accompany the return

Inheritance Tax Return.

established.

if a business interest qualifies for the

“small business” exemption. All informa-

File Number

Number of Employees: List the num-

tion verifying the qualifications of the

ber of full-time equivalent employees

Enter the file number of the estate as-

business interest must be presented

employed by the business on the date

with the return along with a written

signed by the Register of Wills as

of death.

statement explaining in detail how the

shown on REV-1500, Pennsylvania In-

Net Book Value: List the net book

business interest qualifies for the

heritance Tax Return.

value of assets of the business on the

claimed exemption.

1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1