Form Sc Sch. Tc-57a - Instructions

ADVERTISEMENT

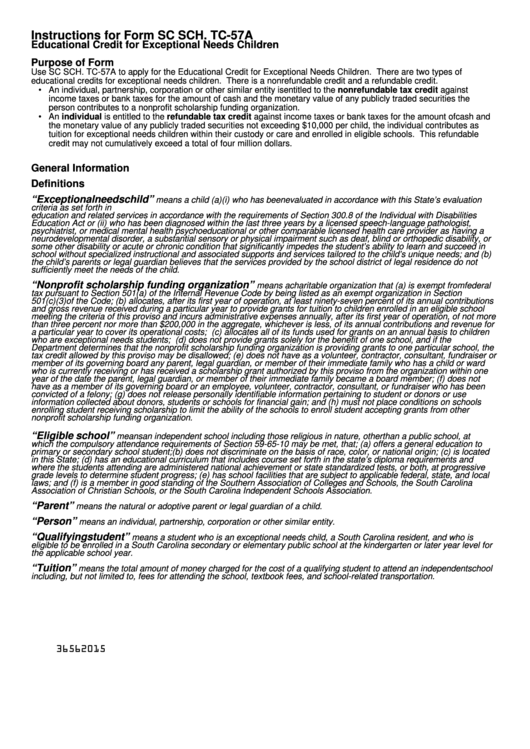

Instructions for Form SC SCH. TC-57A

Educational Credit for Exceptional Needs Children

Purpose of Form

Use SC SCH. TC-57A to apply for the Educational Credit for Exceptional Needs Children. There are two types of

educational credits for exceptional needs children. There is a nonrefundable credit and a refundable credit.

•

An individual, partnership, corporation or other similar entity is entitled to the nonrefundable tax credit against

income taxes or bank taxes for the amount of cash and the monetary value of any publicly traded securities the

person contributes to a nonprofit scholarship funding organization.

•

An individual is entitled to the refundable tax credit against income taxes or bank taxes for the amount of cash and

the monetary value of any publicly traded securities not exceeding $10,000 per child, the individual contributes as

tuition for exceptional needs children within their custody or care and enrolled in eligible schools. This refundable

credit may not cumulatively exceed a total of four million dollars.

General Information

Definitions

“Exceptional needs child”

means a child (a)(i) who has been evaluated in accordance with this State’s evaluation

criteria as set forth in S.C. Code Ann. Regs. 43-243.1 and determined eligible as a child with a disability who needs special

education and related services in accordance with the requirements of Section 300.8 of the Individual with Disabilities

Education Act or (ii) who has been diagnosed within the last three years by a licensed speech-language pathologist,

psychiatrist, or medical mental health psychoeducational or other comparable licensed health care provider as having a

neurodevelopmental disorder, a substantial sensory or physical impairment such as deaf, blind or orthopedic disability, or

some other disability or acute or chronic condition that significantly impedes the student’s ability to learn and succeed in

school without specialized instructional and associated supports and services tailored to the child’s unique needs; and (b)

the child’s parents or legal guardian believes that the services provided by the school district of legal residence do not

sufficiently meet the needs of the child.

“Nonprofit scholarship funding organization”

means a charitable organization that (a) is exempt from federal

tax pursuant to Section 501(a) of the Internal Revenue Code by being listed as an exempt organization in Section

501(c)(3)of the Code; (b) allocates, after its first year of operation, at least ninety-seven percent of its annual contributions

and gross revenue received during a particular year to provide grants for tuition to children enrolled in an eligible school

meeting the criteria of this proviso and incurs administrative expenses annually, after its first year of operation, of not more

than three percent nor more than $200,000 in the aggregate, whichever is less, of its annual contributions and revenue for

a particular year to cover its operational costs; (c) allocates all of its funds used for grants on an annual basis to children

who are exceptional needs students; (d) does not provide grants solely for the benefit of one school, and if the

Department determines that the nonprofit scholarship funding organization is providing grants to one particular school, the

tax credit allowed by this proviso may be disallowed; (e) does not have as a volunteer, contractor, consultant, fundraiser or

member of its governing board any parent, legal guardian, or member of their immediate family who has a child or ward

who is currently receiving or has received a scholarship grant authorized by this proviso from the organization within one

year of the date the parent, legal guardian, or member of their immediate family became a board member; (f) does not

have as a member of its governing board or an employee, volunteer, contractor, consultant, or fundraiser who has been

convicted of a felony; (g) does not release personally identifiable information pertaining to student or donors or use

information collected about donors, students or schools for financial gain; and (h) must not place conditions on schools

enrolling student receiving scholarship to limit the ability of the schools to enroll student accepting grants from other

nonprofit scholarship funding organization.

“Eligible school”

means an independent school including those religious in nature, other than a public school, at

which the compulsory attendance requirements of Section 59-65-10 may be met, that; (a) offers a general education to

primary or secondary school student;(b) does not discriminate on the basis of race, color, or national origin; (c) is located

in this State; (d) has an educational curriculum that includes course set forth in the state’s diploma requirements and

where the students attending are administered national achievement or state standardized tests, or both, at progressive

grade levels to determine student progress; (e) has school facilities that are subject to applicable federal, state, and local

laws; and (f) is a member in good standing of the Southern Association of Colleges and Schools, the South Carolina

Association of Christian Schools, or the South Carolina Independent Schools Association.

“Parent”

means the natural or adoptive parent or legal guardian of a child.

“Person”

means an individual, partnership, corporation or other similar entity.

“Qualifying student”

means a student who is an exceptional needs child, a South Carolina resident, and who is

eligible to be enrolled in a South Carolina secondary or elementary public school at the kindergarten or later year level for

the applicable school year.

“Tuition”

means the total amount of money charged for the cost of a qualifying student to attend an independent school

including, but not limited to, fees for attending the school, textbook fees, and school-related transportation.

36562015

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2