Form M13 - Income Tax Extension Payment

ADVERTISEMENT

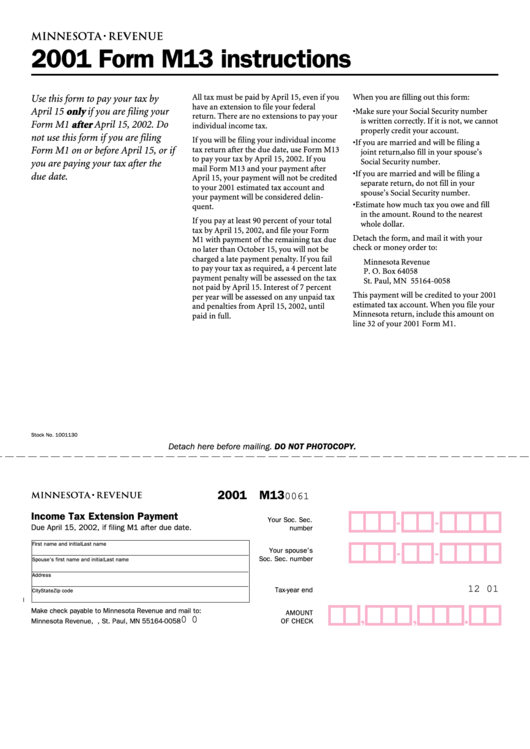

2001 Form M13 instructions

All tax must be paid by April 15, even if you

When you are filling out this form:

Use this form to pay your tax by

have an extension to file your federal

April 15 only if you are filing your

• Make sure your Social Security number

return. There are no extensions to pay your

is written correctly. If it is not, we cannot

Form M1 after April 15, 2002. Do

individual income tax.

properly credit your account.

not use this form if you are filing

If you will be filing your individual income

• If you are married and will be filing a

tax return after the due date, use Form M13

Form M1 on or before April 15, or if

joint return, also fill in your spouse’s

to pay your tax by April 15, 2002. If you

Social Security number.

you are paying your tax after the

mail Form M13 and your payment after

• If you are married and will be filing a

due date.

April 15, your payment will not be credited

separate return, do not fill in your

to your 2001 estimated tax account and

spouse’s Social Security number.

your payment will be considered delin-

• Estimate how much tax you owe and fill

quent.

in the amount. Round to the nearest

If you pay at least 90 percent of your total

whole dollar.

tax by April 15, 2002, and file your Form

Detach the form, and mail it with your

M1 with payment of the remaining tax due

check or money order to:

no later than October 15, you will not be

charged a late payment penalty. If you fail

Minnesota Revenue

to pay your tax as required, a 4 percent late

P. O. Box 64058

payment penalty will be assessed on the tax

St. Paul, MN 55164-0058

not paid by April 15. Interest of 7 percent

This payment will be credited to your 2001

per year will be assessed on any unpaid tax

estimated tax account. When you file your

and penalties from April 15, 2002, until

Minnesota return, include this amount on

paid in full.

line 32 of your 2001 Form M1.

Stock No. 1001130

Detach here before mailing. DO NOT PHOTOCOPY.

2001 M13

0061

Income Tax Extension Payment

Your Soc. Sec.

Due April 15, 2002, if filing M1 after due date.

number

First name and initial

Last name

Your spouse’s

Soc. Sec. number

Spouse’s first name and initial

Last name

Address

12 01

Tax-year end

City

State

Zip code

I

Make check payable to Minnesota Revenue and mail to:

AMOUNT

.

,

,

0 0

OF CHECK

Minnesota Revenue, P.O. Box 64058, St. Paul, MN 55164-0058

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1