Form De 927b - Installment Agreement Request Instructions

ADVERTISEMENT

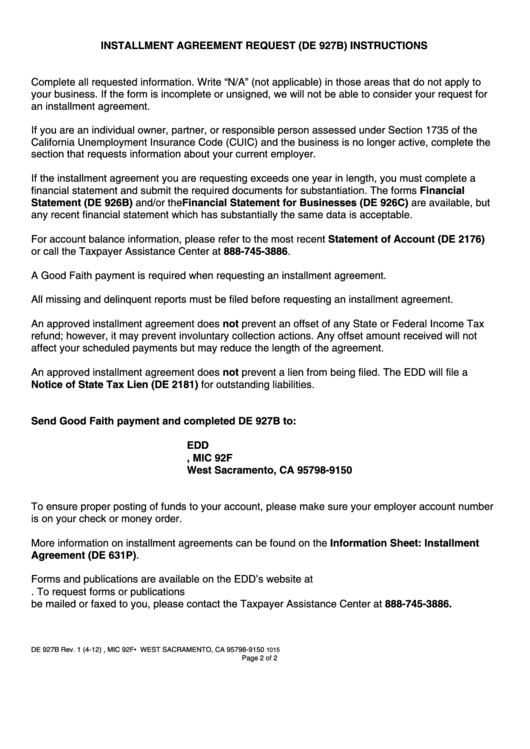

INSTALLMENT AGREEMENT REQUEST (DE 927B) INSTRUCTIONS

Complete all requested information. Write “N/A” (not applicable) in those areas that do not apply to

your business. If the form is incomplete or unsigned, we will not be able to consider your request for

an installment agreement.

If you are an individual owner, partner, or responsible person assessed under Section 1735 of the

California Unemployment Insurance Code (CUIC) and the business is no longer active, complete the

section that requests information about your current employer.

If the installment agreement you are requesting exceeds one year in length, you must complete a

financial statement and submit the required documents for substantiation. The forms Financial

Statement (DE 926B) and/or the Financial Statement for Businesses (DE 926C) are available, but

any recent financial statement which has substantially the same data is acceptable.

For account balance information, please refer to the most recent Statement of Account (DE 2176)

or call the Taxpayer Assistance Center at 888-745-3886.

A Good Faith payment is required when requesting an installment agreement.

All missing and delinquent reports must be filed before requesting an installment agreement.

An approved installment agreement does not prevent an offset of any State or Federal Income Tax

refund; however, it may prevent involuntary collection actions. Any offset amount received will not

affect your scheduled payments but may reduce the length of the agreement.

An approved installment agreement does not prevent a lien from being filed. The EDD will file a

Notice of State Tax Lien (DE 2181) for outstanding liabilities.

Send Good Faith payment and completed DE 927B to:

EDD

P.O. Box 989150, MIC 92F

West Sacramento, CA 95798-9150

To ensure proper posting of funds to your account, please make sure your employer account number

is on your check or money order.

More information on installment agreements can be found on the Information Sheet: Installment

Agreement (DE 631P).

Forms and publications are available on the EDD’s website at

To request forms or publications

be mailed or faxed to you, please contact the Taxpayer Assistance Center at 888-745-3886.

P.O. BOX 989150, MIC 92F • WEST SACRAMENTO, CA 95798-9150

1015

DE 927B Rev. 1 (4-12)

Page 2 of 2

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1