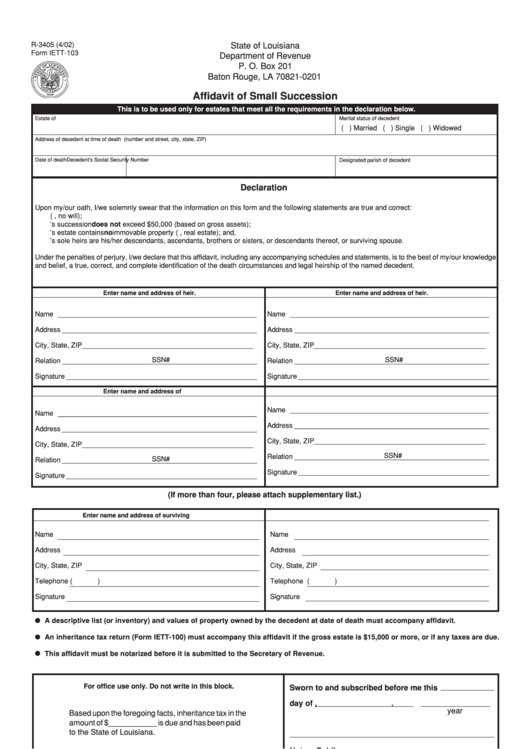

R-3405 (4/02)

State of Louisiana

Form IETT-103

Department of Revenue

P. O. Box 201

Baton Rouge, LA 70821-0201

Affidavit of Small Succession

This is to be used only for estates that meet all the requirements in the declaration below.

Estate of

Marital status of decedent

( ) Married ( ) Single ( ) Widowed

Address of decedent at time of death (number and street, city, state, ZIP)

Date of death

Decedent’s Social Security Number

Designated parish of decedent

Declaration

Upon my/our oath, I/we solemnly swear that the information on this form and the following statements are true and correct:

1. The decedent died intestate (i.e., no will);

2. The value of the decedent’s succession does not exceed $50,000 (based on gross assets);

3. The decedent’s estate contains no immovable property (i.e., real estate); and,

4. The decedent’s sole heirs are his/her descendants, ascendants, brothers or sisters, or descendants thereof, or surviving spouse.

Under the penalties of perjury, I/we declare that this affidavit, including any accompanying schedules and statements, is to the best of my/our knowledge

and belief, a true, correct, and complete identification of the death circumstances and legal heirship of the named decedent.

Enter name and address of heir.

Enter name and address of heir.

Name ___________________________________________________

Name ___________________________________________________

Address __________________________________________________

Address __________________________________________________

City, State, ZIP ____________________________________________

City, State, ZIP ____________________________________________

SSN#

SSN#

Relation __________________________________________________

Relation __________________________________________________

Signature _________________________________________________

Signature _________________________________________________

Enter name and address of heir.

Enter name and address of heir.

Name ___________________________________________________

Name ___________________________________________________

Address __________________________________________________

Address __________________________________________________

City, State, ZIP ____________________________________________

City, State, ZIP ____________________________________________

SSN#

Relation __________________________________________________

SSN#

Relation __________________________________________________

Signature _________________________________________________

Signature _________________________________________________

(If more than four, please attach supplementary list.)

Enter name and address of surviving spouse.

Enter name and address of preparer.

Name

Name

Address

Address

City, State, ZIP

City, State, ZIP

Telephone (

)

Telephone (

)

Signature

Signature

A descriptive list (or inventory) and values of property owned by the decedent at date of death must accompany affidavit.

An inheritance tax return (Form IETT-100) must accompany this affidavit if the gross estate is $15,000 or more, or if any taxes are due.

This affidavit must be notarized before it is submitted to the Secretary of Revenue.

For office use only. Do not write in this block.

Sworn to and subscribed before me this

day of

,

.

year

Based upon the foregoing facts, inheritance tax in the

amount of $ ___________ is due and has been paid

to the State of Louisiana.

Notary Public

By _____________________________________

Louisiana Department of Revenue

For assistance with inheritance tax questions, call the Inheritance,

Telephone: (225) 219-0067

Gift, and Estate Transfer Taxes Section at (225) 219-0067, TDD

(225) 219-2114, or write to:

Date:

/

/

Louisiana Department of Revenue

Inheritance, Gift, and Estate Transfer Taxes Section

P. O. Box 201

Baton Rouge, LA 70821-0201

The Department of Revenue retains the right of review

under Article 2954 of the Code of Civil Procedure.

1

1