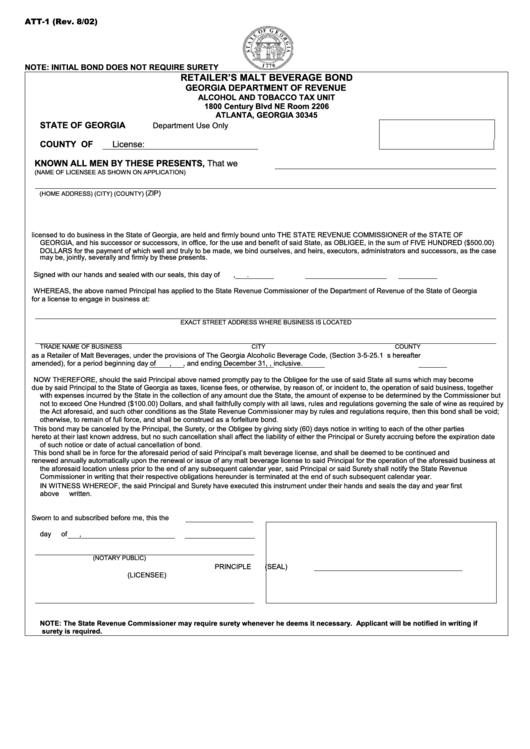

Form Att-1 - Retailer'S Malt Beverage Bond Form - Georgia Department Of Revenue Alcohol And Tobacco Tax Unit

ADVERTISEMENT

ATT-1 (Rev. 8/02)

NOTE: INITIAL BOND DOES NOT REQUIRE SURETY

RETAILER’S MALT BEVERAGE BOND

GEORGIA DEPARTMENT OF REVENUE

ALCOHOL AND TOBACCO TAX UNIT

1800 Century Blvd NE Room 2206

ATLANTA, GEORGIA 30345

STATE OF GEORGIA

Department Use Only

COUNTY OF

License:

KNOWN ALL MEN BY THESE PRESENTS, That we

(NAME OF LICENSEE AS SHOWN ON APPLICATION)

(ZIP)

(HOME ADDRESS)

(CITY)

(COUNTY)

licensed to do business in the State of Georgia, are held and firmly bound unto THE STATE REVENUE COMMISSIONER of the STATE OF

GEORGIA, and his successor or successors, in office, for the use and benefit of said State, as OBLIGEE, in the sum of FIVE HUNDRED ($500.00)

DOLLARS for the payment of which well and truly to be made, we bind ourselves, and heirs, executors, administrators and successors, as the case

may be, jointly, severally and firmly by these presents.

Signed with our hands and sealed with our seals, this

day of

,

.

WHEREAS, the above named Principal has applied to the State Revenue Commissioner of the Department of Revenue of the State of Georgia

for a license to engage in business at:

EXACT STREET ADDRESS WHERE BUSINESS IS LOCATED

TRADE NAME OF BUSINESS

CITY

COUNTY

ZIP

as a Retailer of Malt Beverages, under the provisions of The Georgia Alcoholic Beverage Code, (Section 3-5-25.1 O.C.G.A. and as hereafter

amended), for a period beginning

day of

,

, and ending December 31,

, inclusive.

NOW THEREFORE, should the said Principal above named promptly pay to the Obligee for the use of said State all sums which may become

due by said Principal to the State of Georgia as taxes, license fees, or otherwise, by reason of, or incident to, the operation of said business, together

with expenses incurred by the State in the collection of any amount due the State, the amount of expense to be determined by the Commissioner but

not to exceed One Hundred ($100.00) Dollars, and shall faithfully comply with all laws, rules and regulations governing the sale of wine as required by

the Act aforesaid, and such other conditions as the State Revenue Commissioner may by rules and regulations require, then this bond shall be void;

otherwise, to remain of full force, and shall be construed as a forfeiture bond.

This bond may be canceled by the Principal, the Surety, or the Obligee by giving sixty (60) days notice in writing to each of the other parties

hereto at their last known address, but no such cancellation shall affect the liability of either the Principal or Surety accruing before the expiration date

of such notice or date of actual cancellation of bond.

This bond shall be in force for the aforesaid period of said Principal’s malt beverage license, and shall be deemed to be continued and

renewed annually automatically upon the renewal or issue of any malt beverage license to said Principal for the operation of the aforesaid business at

the aforesaid location unless prior to the end of any subsequent calendar year, said Principal or said Surety shall notify the State Revenue

Commissioner in writing that their respective obligations hereunder is terminated at the end of such subsequent calendar year.

IN WITNESS WHEREOF, the said Principal and Surety have executed this instrument under their hands and seals the day and year first

above written.

Sworn to and subscribed before me, this the

day of

,

(NOTARY PUBLIC)

PRINCIPLE

(SEAL)

(LICENSEE)

NOTE:

The State Revenue Commissioner may require surety whenever he deems it necessary. Applicant will be notified in writing if

surety is required.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1