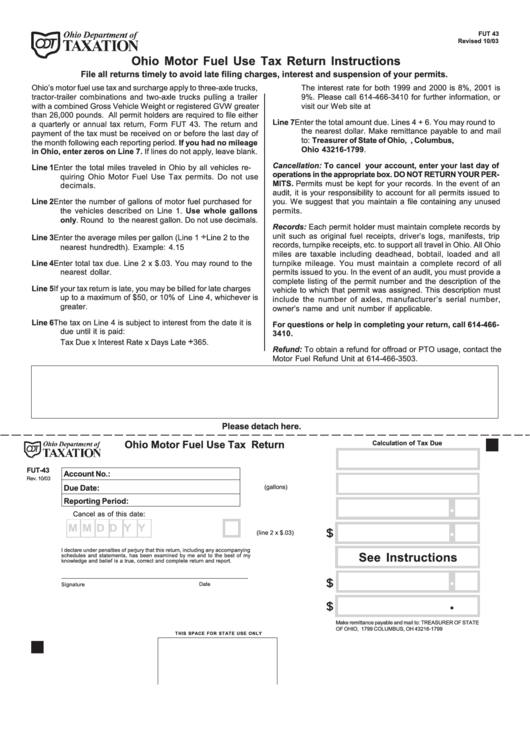

Form Fut 43 - Ohio Motor Fuel Use Tax Return Form - Ohio Department Of Taxation

ADVERTISEMENT

FUT 43

Revised 10/03

Ohio Motor Fuel Use Tax Return Instructions

File all returns timely to avoid late filing charges, interest and suspension of your permits.

Ohio’s motor fuel use tax and surcharge apply to three-axle trucks,

The interest rate for both 1999 and 2000 is 8%, 2001 is

tractor-trailer combinations and two-axle trucks pulling a trailer

9%. Please call 614-466-3410 for further information, or

with a combined Gross Vehicle Weight or registered GVW greater

visit our Web site at .

than 26,000 pounds. All permit holders are required to file either

Line 7 Enter the total amount due. Lines 4 + 6. You may round to

a quarterly or annual tax return, Form FUT 43. The return and

the nearest dollar. Make remittance payable to and mail

payment of the tax must be received on or before the last day of

to: Treasurer of State of Ohio, P.O. Box 1799, Columbus,

the month following each reporting period. If you had no mileage

Ohio 43216-1799.

in Ohio, enter zeros on Line 7. If lines do not apply, leave blank.

Cancellation: To cancel your account, enter your last day of

Line 1 Enter the total miles traveled in Ohio by all vehicles re-

operations in the appropriate box. DO NOT RETURN YOUR PER-

quiring Ohio Motor Fuel Use Tax permits. Do not use

MITS. Permits must be kept for your records. In the event of an

decimals.

audit, it is your responsibility to account for all permits issued to

Line 2 Enter the number of gallons of motor fuel purchased for

you. We suggest that you maintain a file containing any unused

the vehicles described on Line 1. Use whole gallons

permits.

only. Round to the nearest gallon. Do not use decimals.

Records: Each permit holder must maintain complete records by

÷

unit such as original fuel receipts, driver’s logs, manifests, trip

Line 3 Enter the average miles per gallon (Line 1

Line 2 to the

records, turnpike receipts, etc. to support all travel in Ohio. All Ohio

nearest hundredth). Example: 4.15

miles are taxable including deadhead, bobtail, loaded and all

Line 4 Enter total tax due. Line 2 x $.03. You may round to the

turnpike mileage. You must maintain a complete record of all

nearest dollar.

permits issued to you. In the event of an audit, you must provide a

complete listing of the permit number and the description of the

Line 5 If your tax return is late, you may be billed for late charges

vehicle to which that permit was assigned. This description must

up to a maximum of $50, or 10% of Line 4, whichever is

include the number of axles, manufacturer ’s serial number,

greater.

owner’s name and unit number if applicable.

Line 6 The tax on Line 4 is subject to interest from the date it is

For questions or help in completing your return, call 614-466-

due until it is paid:

3410.

÷

Tax Due x Interest Rate x Days Late

365.

Refund: To obtain a refund for offroad or PTO usage, contact the

Motor Fuel Refund Unit at 614-466-3503.

Please detach here.

Ohio Motor Fuel Use Tax Return

Calculation of Tax Due

1. Total miles traveled

FUT-43

Account No.:

Rev. 10/03

2. Total fuel purchased

Due Date:

(gallons)

Reporting Period:

.

3. Average miles per gallon

Cancel as of this

date:

.

M M D D Y Y

$

4. Tax due (line 2 x $.03)

I declare under penalties of perjury that this return, including any accompanying

See Instructions

schedules and statements, has been examined by me and to the best of my

5. Late filing charge

knowledge and belief is a true, correct and complete return and report.

.

6. Interest due

$

Date

Signature

.

$

7. Total due

Make remittance payable and mail to: TREASURER OF STATE

OF OHIO, P.O. BOX 1799 COLUMBUS, OH 43216-1799

THIS SPACE FOR STATE USE ONLY

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1