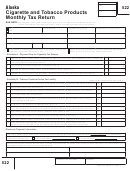

FORM M-19

Page 4

(REV. 2006)

PART III - SCHEDULE OF CIGARETTE BRANDS SOLD

List the cigarette brand, cigarette brand style, and number of cigarettes sold (both wholesale and retail sales) during the month:

Cigarette Brand

Cigarette Brand Style

Number of Cigarettes Sold

Total Number of Cigarettes Sold

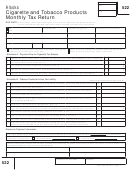

PART IV - SCHEDULE OF CIGARETTES SOLD, USED, AND POSSESSED

CIGARETTES

TOTAL WHOLESALE VALUE

1. Number of cigarettes sold at wholesale during the month .......................................................

$

1

2. Number of cigarettes sold at retail during the month ...............................................................

$

2

3. Number of cigarettes used during the month subject to the tax...............................................

$

3

4. Total number of cigarettes sold and used during the month (add lines 1, 2, and 3).................................................................

4

5. Less non-taxable sales (Number of cigarettes from page 2, Part I, Non-Taxable Sales of Cigarettes) ...................................

5

6. Total taxable cigarettes (line 4 minus line 5) ............................................................................................................................

6

PART V - CIGARETTE TAX STAMPS INVENTORY

Caution: See instructions before completing Part V.

BLUE STAMPS

ORANGE STAMPS

1.

Number of cigarette tax stamps on hand at beginning of the month . . . . . . . . . . . . . . . . .

2.

Number of cigarette tax stamps purchased during the month . . . . . . . . . . . . . . . . . . . . .

3.

Number of cigarette tax stamps transferred in during the month . . . . . . . . . . . . . . . . . . .

4.

Add lines 1, 2, and 3. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5.

Number of cigarette tax stamps affixed to cigarette packages during the month . . . . . . . . . . .

6.

Number of cigarette tax stamps transferred out during the month . . . . . . . . . . . . . . . . . .

7.

Number of unused cigarette tax stamps returned for a refund during the month . . . . . . . . . . .

8.

Add lines 5, 6, and 7. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

9.

Number of cigarette tax stamps on hand at end of the month (line 4 minus line 8) . . . . . . . . . .

1

1 2

2 3

3 4

4