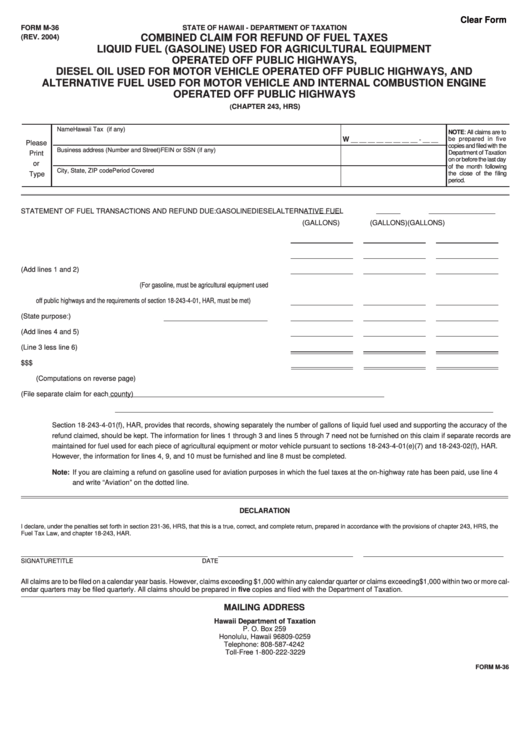

Clear Form

FORM M-36

STATE OF HAWAII - DEPARTMENT OF TAXATION

COMBINED CLAIM FOR REFUND OF FUEL TAXES

(REV. 2004)

LIQUID FUEL (GASOLINE) USED FOR AGRICULTURAL EQUIPMENT

OPERATED OFF PUBLIC HIGHWAYS,

DIESEL OIL USED FOR MOTOR VEHICLE OPERATED OFF PUBLIC HIGHWAYS, AND

ALTERNATIVE FUEL USED FOR MOTOR VEHICLE AND INTERNAL COMBUSTION ENGINE

OPERATED OFF PUBLIC HIGHWAYS

CHAPTER 243, HRS)

(

Name

Hawaii Tax I.D. No. (if any)

NOTE: All claims are to

W

be prepared in five

__ __ __ __ __ __ __ __ - __ __

Please

copies and filed with the

Business address (Number and Street)

FEIN or SSN (if any)

Print

Department of Taxation

on or before the last day

or

of the month following

City, State, ZIP code

Period Covered

Type

the close of the filing

period.

STATEMENT OF FUEL TRANSACTIONS AND REFUND DUE:

GASOLINE

DIESEL

ALTERNATIVE FUEL

(GALLONS)

(GALLONS)

(GALLONS)

1.

On hand at beginning of period.............................................................................

2.

Purchases .............................................................................................................

3.

Total (Add lines 1 and 2) .......................................................................................

4.

USED OFF PUBLIC HIGHWAYS (For gasoline, must be agricultural equipment used

off public highways and the requirements of section 18-243-4-01, HAR, must be met) ...............

5.

Used for other purposes (State purpose:

) .....

6.

Total (Add lines 4 and 5) .......................................................................................

7.

On hand at end of period (Line 3 less line 6) ........................................................

8.

REFUND ON GALLONS USED AS SHOWN ON LINE 4 ..................................... $

$

$

(Computations on reverse page)

9.

Used in the County of

(File separate claim for each county)

10. Name of seller or sellers

Section 18-243-4-01(f), HAR, provides that records, showing separately the number of gallons of liquid fuel used and supporting the accuracy of the

refund claimed, should be kept. The information for lines 1 through 3 and lines 5 through 7 need not be furnished on this claim if separate records are

maintained for fuel used for each piece of agricultural equipment or motor vehicle pursuant to sections 18-243-4-01(e)(7) and 18-243-02(f), HAR.

However, the information for lines 4, 9, and 10 must be furnished and line 8 must be completed.

Note: If you are claiming a refund on gasoline used for aviation purposes in which the fuel taxes at the on-highway rate has been paid, use line 4

and write “Aviation” on the dotted line.

DECLARATION

I declare, under the penalties set forth in section 231-36, HRS, that this is a true, correct, and complete return, prepared in accordance with the provisions of chapter 243, HRS, the

Fuel Tax Law, and chapter 18-243, HAR.

SIGNATURE

TITLE

DATE

All claims are to be filed on a calendar year basis. However, claims exceeding $1,000 within any calendar quarter or claims exceeding $1,000 within two or more cal-

endar quarters may be filed quarterly. All claims should be prepared in five copies and filed with the Department of Taxation.

MAILING ADDRESS

Hawaii Department of Taxation

P. O. Box 259

Honolulu, Hawaii 96809-0259

Telephone: 808-587-4242

Toll-Free 1-800-222-3229

FORM M-36

1

1 2

2