Form 10a070 - Authorization Agreement For Electronic Funds Transfer - 2008

ADVERTISEMENT

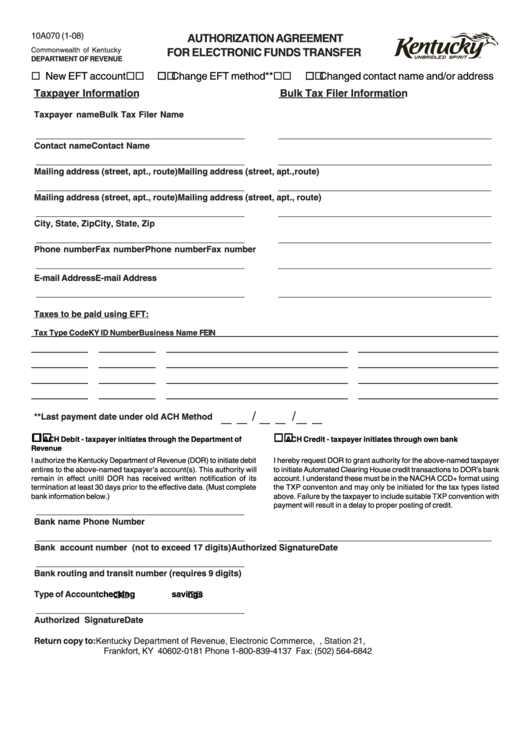

10A070 (1-08)

AUTHORIZATION AGREEMENT

Commonwealth of Kentucky

FOR ELECTRONIC FUNDS TRANSFER

DEPARTMENT OF REVENUE

New EFT account

Change EFT method**

Changed contact name and/or address

Taxpayer Information

Bulk Tax Filer Information

Taxpayer name

Bulk Tax Filer Name

____________________________________________

_____________________________________________

Contact name

Contact Name

____________________________________________

_____________________________________________

Mailing address (street, apt., route)

Mailing address (street, apt.,route)

____________________________________________

_____________________________________________

Mailing address (street, apt., route)

Mailing address (street, apt., route)

____________________________________________

_____________________________________________

City, State, Zip

City, State, Zip

____________________________________________

_____________________________________________

Phone number

Fax number

Phone number

Fax number

____________________________________________

_____________________________________________

E-mail Address

E-mail Address

____________________________________________

_____________________________________________

Taxes to be paid using EFT:

Tax Type Code

KY ID Number

Business Name

FEIN

/

/

**Last payment date under old ACH Method

ACH Debit - taxpayer initiates through the Department of

ACH Credit - taxpayer initiates through own bank

Revenue

I authorize the Kentucky Department of Revenue (DOR) to initiate debit

I hereby request DOR to grant authority for the above-named taxpayer

entires to the above-named taxpayer’s account(s). This authority will

to initiate Automated Clearing House credit transactions to DOR’s bank

remain in effect unitil DOR has received written notification of its

account. I understand these must be in the NACHA CCD+ format using

termination at least 30 days prior to the effective date. (Must complete

the TXP conventon and may only be initiated for the tax types listed

bank information below.)

above. Failure by the taxpayer to include suitable TXP convention with

payment will result in a delay to proper posting of credit.

____________________________________________

Bank name

Phone Number

____________________________________________

_____________________________________________

Bank account number (not to exceed 17 digits)

Authorized Signature

Date

____________________________________________

Bank routing and transit number (requires 9 digits)

Type of Account

checking

savings

____________________________________________

Authorized Signature

Date

Return copy to: Kentucky Department of Revenue, Electronic Commerce, P.O. Box 181, Station 21,

Frankfort, KY 40602-0181

Phone 1-800-839-4137

Fax: (502) 564-6842

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1