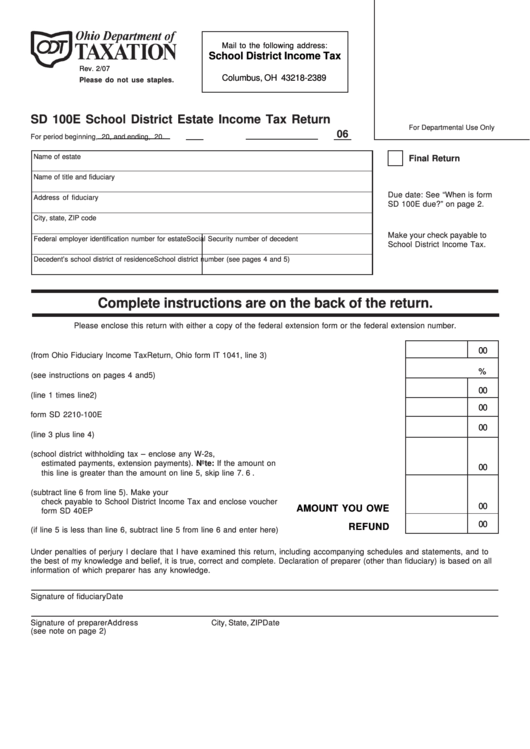

Mail to the following address:

School District Income Tax

P.O. Box 182389

Rev. 2/07

Columbus, OH 43218-2389

Please do not use staples.

Reset Form

SD 100E School District Estate Income Tax Return

For Departmental Use Only

06

For period beginning

, 20

, and ending

, 20

.

Name of estate

Final Return

Name of title and fiduciary

Due date: See “When is form

Address of fiduciary

SD 100E due?” on page 2.

City, state, ZIP code

Make your check payable to

Federal employer identification number for estate

Social Security number of decedent

School District Income Tax.

Decedent’s school district of residence

School district number (see pages 4 and 5)

Complete instructions are on the back of the return.

Please enclose this return with either a copy of the federal extension form or the federal extension number.

00

1. Ohio taxable income (from Ohio Fiduciary Income Tax Return, Ohio form IT 1041, line 3) ................. 1.

%

2. School district income tax rate (see instructions on pages 4 and 5) ................................................... 2.

00

3. School district income tax (line 1 times line 2) ...................................................................................... 3.

00

4. Interest penalty. Enclose form SD 2210-100E ....................................................................................... 4.

00

5. Tax and interest penalty (line 3 plus line 4) ........................................................................................... 5.

6. Payments (school district withholding tax – enclose any W-2s,

estimated payments, extension payments). Note: If the amount on

00

this line is greater than the amount on line 5, skip line 7 ..................................................................... 6.

7. Tax and interest penalty due (subtract line 6 from line 5). Make your

check payable to School District Income Tax and enclose voucher

00

AMOUNT YOU OWE

form SD 40EP .......................................................................................................................................... 7.

00

REFUND

8. Refund (if line 5 is less than line 6, subtract line 5 from line 6 and enter here) .................................. 8.

Under penalties of perjury I declare that I have examined this return, including accompanying schedules and statements, and to

the best of my knowledge and belief, it is true, correct and complete. Declaration of preparer (other than fiduciary) is based on all

information of which preparer has any knowledge.

Signature of fiduciary

Date

Signature of preparer

Address

City, State, ZIP

Date

(see note on page 2)

1

1