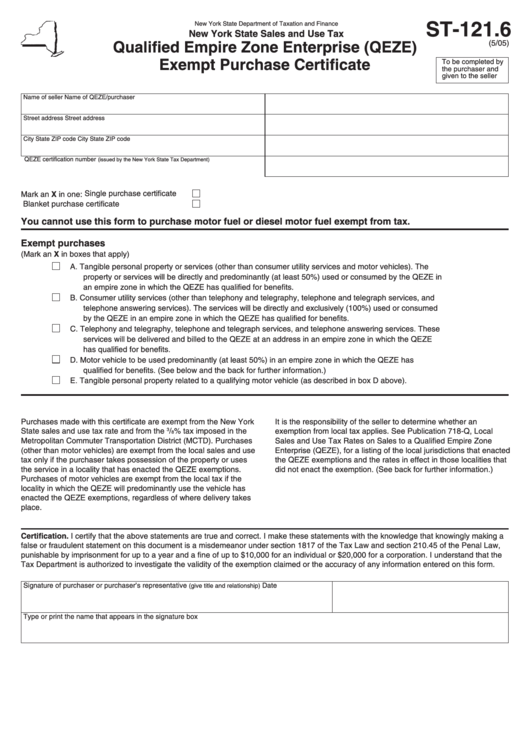

ST-121.6

New York State Department of Taxation and Finance

New York State Sales and Use Tax

Qualified Empire Zone Enterprise (QEZE)

(5/05)

Exempt Purchase Certificate

To be completed by

the purchaser and

given to the seller

Name of seller

Name of QEZE/purchaser

Street address

Street address

City

State

ZIP code

City

State

ZIP code

QEZE certification number

(issued by the New York State Tax Department)

Single purchase certificate

Mark an X in one:

Blanket purchase certificate

You cannot use this form to purchase motor fuel or diesel motor fuel exempt from tax.

Exempt purchases

(Mark an X in boxes that apply)

A. Tangible personal property or services (other than consumer utility services and motor vehicles). The

property or services will be directly and predominantly (at least 50%) used or consumed by the QEZE in

an empire zone in which the QEZE has qualified for benefits.

B. Consumer utility services (other than telephony and telegraphy, telephone and telegraph services, and

telephone answering services). The services will be directly and exclusively (100%) used or consumed

by the QEZE in an empire zone in which the QEZE has qualified for benefits.

C. Telephony and telegraphy, telephone and telegraph services, and telephone answering services. These

services will be delivered and billed to the QEZE at an address in an empire zone in which the QEZE

has qualified for benefits.

D. Motor vehicle to be used predominantly (at least 50%) in an empire zone in which the QEZE has

qualified for benefits. (See below and the back for further information.)

E. Tangible personal property related to a qualifying motor vehicle (as described in box D above).

Purchases made with this certificate are exempt from the New York

It is the responsibility of the seller to determine whether an

State sales and use tax rate and from the

3

/

% tax imposed in the

exemption from local tax applies. See Publication 718-Q, Local

8

Metropolitan Commuter Transportation District (MCTD). Purchases

Sales and Use Tax Rates on Sales to a Qualified Empire Zone

(other than motor vehicles) are exempt from the local sales and use

Enterprise (QEZE), for a listing of the local jurisdictions that enacted

tax only if the purchaser takes possession of the property or uses

the QEZE exemptions and the rates in effect in those localities that

the service in a locality that has enacted the QEZE exemptions.

did not enact the exemption. (See back for further information.)

Purchases of motor vehicles are exempt from the local tax if the

locality in which the QEZE will predominantly use the vehicle has

enacted the QEZE exemptions, regardless of where delivery takes

place.

Certification. I certify that the above statements are true and correct. I make these statements with the knowledge that knowingly making a

false or fraudulent statement on this document is a misdemeanor under section 1817 of the Tax Law and section 210.45 of the Penal Law,

punishable by imprisonment for up to a year and a fine of up to $10,000 for an individual or $20,000 for a corporation. I understand that the

Tax Department is authorized to investigate the validity of the exemption claimed or the accuracy of any information entered on this form.

Signature of purchaser or purchaser’s representative

Date

(give title and relationship)

Type or print the name that appears in the signature box

1

1