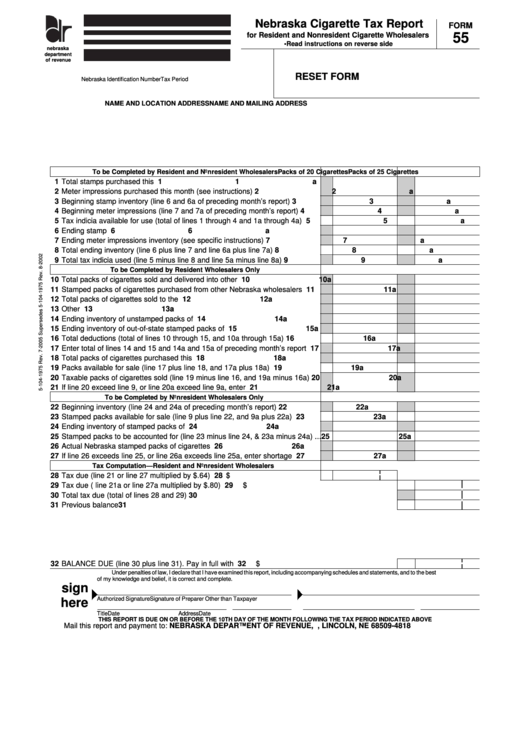

Nebraska Cigarette Tax Report

FORM

for Resident and Nonresident Cigarette Wholesalers

55

• Read instructions on reverse side

nebraska

department

of revenue

RESET FORM

Nebraska Identification Number

Tax Period

NAME AND LOCATION ADDRESS

NAME AND MAILING ADDRESS

To be Completed by Resident and Nonresident Wholesalers

Packs of 20 Cigarettes

Packs of 25 Cigarettes

1 Total stamps purchased this month ....................................................................

1

1a

2 Meter impressions purchased this month (see instructions) ...............................

2

2a

3 Beginning stamp inventory (line 6 and 6a of preceding month’s report) .............

3

3a

4 Beginning meter impressions (line 7 and 7a of preceding month’s report) .........

4

4a

5 Tax indicia available for use (total of lines 1 through 4 and 1a through 4a) .......

5

5a

6 Ending stamp inventory .......................................................................................

6

6a

7 Ending meter impressions inventory (see specific instructions) ..........................

7

7a

8 Total ending inventory (line 6 plus line 7 and line 6a plus line 7a) .....................

8

8a

9 Total tax indicia used (line 5 minus line 8 and line 5a minus line 8a) .................

9

9a

To be Completed by Resident Wholesalers Only

10 Total packs of cigarettes sold and delivered into other states ............................ 10

10a

11 Stamped packs of cigarettes purchased from other Nebraska wholesalers ....... 11

11a

12 Total packs of cigarettes sold to the U.S. government or its agencies ............... 12

12a

13 Other deductions ................................................................................................. 13

13a

14 Ending inventory of unstamped packs of cigarettes ............................................ 14

14a

15 Ending inventory of out-of-state stamped packs of cigarettes ............................ 15

15a

16 Total deductions (total of lines 10 through 15, and 10a through 15a) ................ 16

16a

17 Enter total of lines 14 and 15 and 14a and 15a of preceding month’s report ..... 17

17a

18 Total packs of cigarettes purchased this month .................................................. 18

18a

19 Packs available for sale (line 17 plus line 18, and 17a plus 18a) ....................... 19

19a

20 Taxable packs of cigarettes sold (line 19 minus line 16, and 19a minus 16a) .... 20

20a

21 If line 20 exceed line 9, or line 20a exceed line 9a, enter shortage .................... 21

21a

To be Completed by Nonresident Wholesalers Only

22 Beginning inventory (line 24 and 24a of preceding month’s report) ................... 22

22a

23 Stamped packs available for sale (line 9 plus line 22, and 9a plus 22a) ............ 23

23a

24 Ending inventory of stamped packs of cigarettes ................................................ 24

24a

25 Stamped packs to be accounted for (line 23 minus line 24, & 23a minus 24a) ... 25

25a

26 Actual Nebraska stamped packs of cigarettes sold ............................................ 26

26a

27 If line 26 exceeds line 25, or line 26a exceeds line 25a, enter shortage ............ 27

27a

Tax Computation — Resident and Nonresident Wholesalers

28 Tax due (line 21 or line 27 multiplied by $.64) .................................................... 28 $

29 Tax due ( line 21a or line 27a multiplied by $.80) ..................................................................................... 29

$

30 Total tax due (total of lines 28 and 29) ...................................................................................................... 30

31 Previous balance

31

32 BALANCE DUE (line 30 plus line 31). Pay in full with report .................................................................... 32

$

Under penalties of law, I declare that I have examined this report, including accompanying schedules and statements, and to the best

of my knowledge and belief, it is correct and complete.

sign

Authorized Signature

Signature of Preparer Other than Taxpayer

here

Title

Date

Address

Date

THIS REPORT IS DUE ON OR BEFORE THE 10TH DAY OF THE MONTH FOLLOWING THE TAX PERIOD INDICATED ABOVE

Mail this report and payment to: NEBRASKA DEPARTMENT OF REVENUE, P.O. BOX 94818, LINCOLN, NE 68509-4818

1

1 2

2