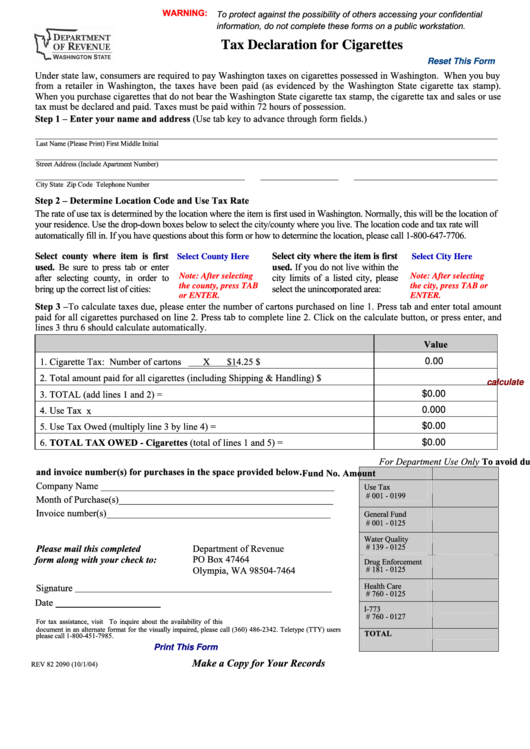

WARNING:

To protect against the possibility of others accessing your confidential

information, do not complete these forms on a public workstation.

Tax Declaration for Cigarettes

Reset This Form

Under state law, consumers are required to pay Washington taxes on cigarettes possessed in Washington. When you buy

from a retailer in Washington, the taxes have been paid (as evidenced by the Washington State cigarette tax stamp).

When you purchase cigarettes that do not bear the Washington State cigarette tax stamp, the cigarette tax and sales or use

tax must be declared and paid. Taxes must be paid within 72 hours of possession.

Step 1 – Enter your name and address (Use tab key to advance through form fields.)

Last Name (Please Print)

First

Middle Initial

Street Address (Include Apartment Number)

City

State

Zip Code

Telephone Number

Step 2 – Determine Location Code and Use Tax Rate

The rate of use tax is determined by the location where the item is first used in Washington. Normally, this will be the location of

your residence. Use the drop-down boxes below to select the city/county where you live. The location code and tax rate will

automatically fill in. If you have questions about this form or how to determine the location, please call 1-800-647-7706.

Select county where item is first

Select city where the item is first

Select County Here

Select City Here

used. Be sure to press tab or enter

used. If you do not live within the

after selecting county, in order to

Note: After selecting

city limits of a listed city, please

Note: After selecting

the county, press TAB

the city, press TAB or

bring up the correct list of cities:

select the unincorporated area:

or ENTER.

ENTER.

Step 3 –To calculate taxes due, please enter the number of cartons purchased on line 1. Press tab and enter total amount

paid for all cigarettes purchased on line 2. Press tab to complete line 2. Click on the calculate button, or press enter, and

lines 3 thru 6 should calculate automatically.

Value

1. Cigarette Tax: Number of cartons

X

$14.25

$

0.00

2. Total amount paid for all cigarettes (including Shipping & Handling) ....................

$

calculate

3. TOTAL (add lines 1 and 2).......................................................................................

=

$0.00

4. Use Tax Rate.............................................................. Location Code ___________

x

0.000

5. Use Tax Owed (multiply line 3 by line 4) ................................................................

=

$0.00

6. TOTAL TAX OWED - Cigarettes (total of lines 1 and 5).....................................

=

$0.00

To avoid duplicate billing, please list company name, month of purchase(s)

For Department Use Only

and invoice number(s) for purchases in the space provided below.

Fund No.

Amount

Company Name _________________________________________________

Use Tax

# 001 - 0199

Month of Purchase(s) _____________________________________________

Invoice number(s) _______________________________________________

General Fund

# 001 - 0125

Water Quality

Department of Revenue

Please mail this completed

# 139 - 0125

form along with your check to:

PO Box 47464

Drug Enforcement

Olympia, WA 98504-7464

# 181 - 0125

Health Care

Signature

# 760 - 0125

Date

I-773

# 760 - 0127

For tax assistance, visit or call 1-800-647-7706. To inquire about the availability of this

document in an alternate format for the visually impaired, please call (360) 486-2342. Teletype (TTY) users

please call 1-800-451-7985.

TOTAL

Print This Form

Make a Copy for Your Records

REV 82 2090 (10/1/04)

1

1