Form Ftb 3701 - Instructions Sheet

ADVERTISEMENT

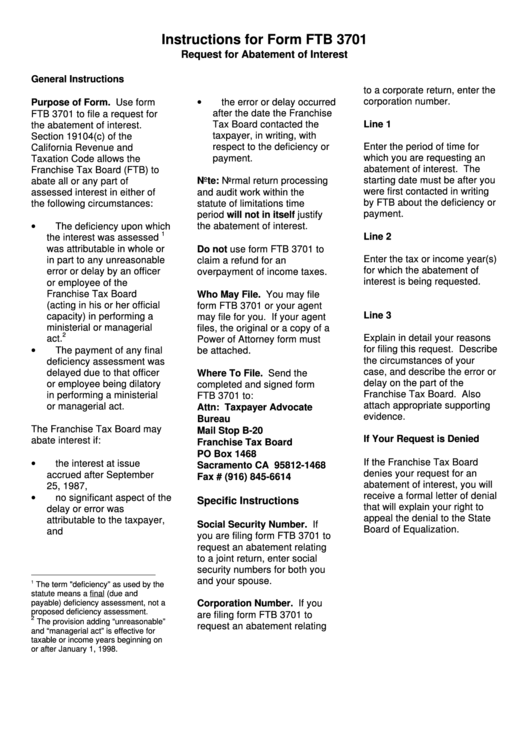

Instructions for Form FTB 3701

Request for Abatement of Interest

General Instructions

to a corporate return, enter the

•

corporation number.

the error or delay occurred

Purpose of Form. Use form

after the date the Franchise

FTB 3701 to file a request for

Tax Board contacted the

Line 1

the abatement of interest.

taxpayer, in writing, with

Section 19104(c) of the

respect to the deficiency or

Enter the period of time for

California Revenue and

payment.

which you are requesting an

Taxation Code allows the

abatement of interest. The

Franchise Tax Board (FTB) to

starting date must be after you

abate all or any part of

Note: Normal return processing

were first contacted in writing

and audit work within the

assessed interest in either of

by FTB about the deficiency or

the following circumstances:

statute of limitations time

payment.

period will not in itself justify

•

the abatement of interest.

The deficiency upon which

1

Line 2

the interest was assessed

was attributable in whole or

Do not use form FTB 3701 to

Enter the tax or income year(s)

in part to any unreasonable

claim a refund for an

for which the abatement of

error or delay by an officer

overpayment of income taxes.

interest is being requested.

or employee of the

Franchise Tax Board

Who May File. You may file

(acting in his or her official

form FTB 3701 or your agent

Line 3

capacity) in performing a

may file for you. If your agent

ministerial or managerial

files, the original or a copy of a

2

Explain in detail your reasons

act.

Power of Attorney form must

•

for filing this request. Describe

The payment of any final

be attached.

the circumstances of your

deficiency assessment was

case, and describe the error or

delayed due to that officer

Where To File. Send the

delay on the part of the

or employee being dilatory

completed and signed form

Franchise Tax Board. Also

in performing a ministerial

FTB 3701 to:

attach appropriate supporting

or managerial act.

Attn: Taxpayer Advocate

evidence.

Bureau

The Franchise Tax Board may

Mail Stop B-20

If Your Request is Denied

abate interest if:

Franchise Tax Board

PO Box 1468

•

If the Franchise Tax Board

the interest at issue

Sacramento CA 95812-1468

denies your request for an

accrued after September

Fax # (916) 845-6614

abatement of interest, you will

25, 1987,

•

receive a formal letter of denial

no significant aspect of the

Specific Instructions

that will explain your right to

delay or error was

appeal the denial to the State

attributable to the taxpayer,

Social Security Number. If

Board of Equalization.

and

you are filing form FTB 3701 to

request an abatement relating

to a joint return, enter social

security numbers for both you

and your spouse.

1

The term "deficiency” as used by the

statute means a final (due and

payable) deficiency assessment, not a

Corporation Number. If you

proposed deficiency assessment.

are filing form FTB 3701 to

2

The provision adding “unreasonable”

request an abatement relating

and “managerial act” is effective for

taxable or income years beginning on

or after January 1, 1998.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1