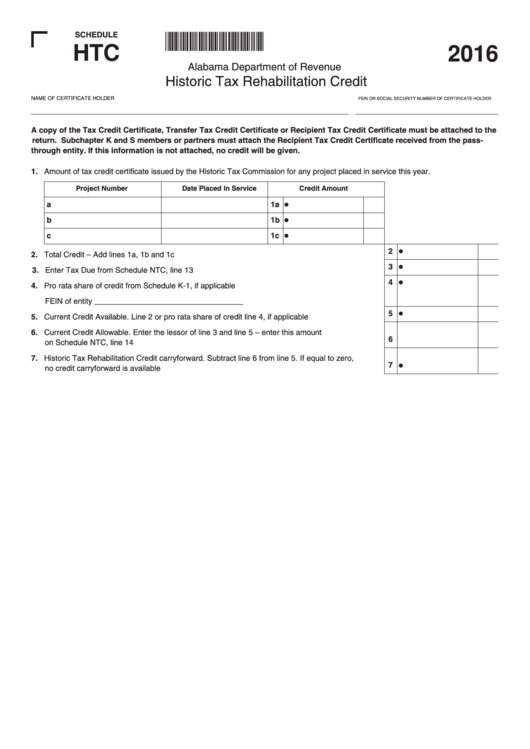

Schedule Htc Form - Historic Tax Rehabilitation Credit Form - 2016

ADVERTISEMENT

S HEDULE

160014HC

HTC

2 16

Alabama Department of Revenue

Historic Tax Rehabilitation Credit

NAME OF CERTIFICATE HOLDER

FEIN OR SOCIAL SECURITY NUMBER OF CERTIFICATE HOLDER

A copy of the Tax Credit Certificate, Transfer Tax Credit Certificate or Recipient Tax Credit Certificate must be attached to the

return. Subchapter K and S members or partners must attach the Recipient Tax Credit Certificate received from the pass-

through entity. If this information is not attached, no credit will be given.

1. Amount of tax credit certificate issued by the Historic Tax Commission for any project placed in service this year.

Project Number

Date Placed In Service

Credit Amount

•

a

1a

•

b

1b

•

c

1c

•

2

2. Total Credit – Add lines 1a, 1b and 1c . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

•

3

3. Enter Tax Due from Schedule NTC, line 13. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

•

4

4. Pro rata share of credit from Schedule K-1, if applicable . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

FEIN of entity __________________________________

•

5

5. Current Credit Available. Line 2 or pro rata share of credit line 4, if applicable. . . . . . . . . . . . . . . . . . . .

6. Current Credit Allowable. Enter the lessor of line 3 and line 5 – enter this amount

6

on Schedule NTC, line 14 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7. Historic Tax Rehabilitation Credit carryforward. Subtract line 6 from line 5. If equal to zero,

•

7

no credit carryforward is available . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1