Form Sctc-1 - Senior Tax Credit Form - 2016

ADVERTISEMENT

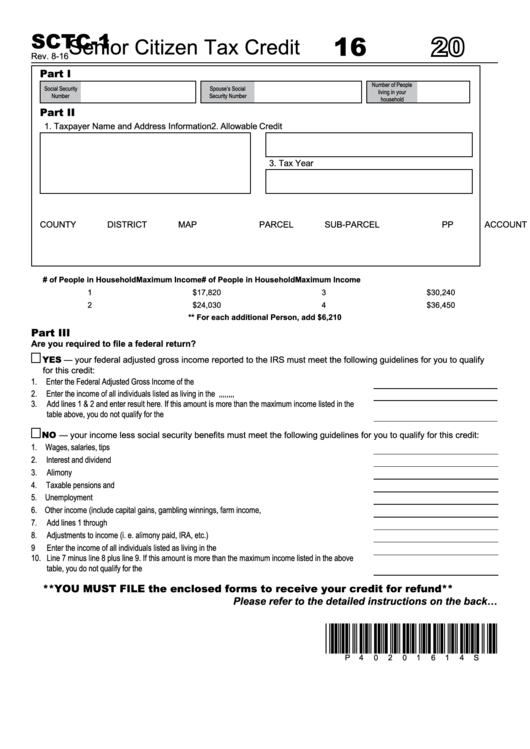

SCTC-1

2016

Senior Citizen Tax Credit

Rev. 8-16

Part I

Number of People

Social Security

Spouse’s Social

living in your

Number

Security Number

household

Part II

1. Taxpayer Name and Address Information

2. Allowable Credit

3. Tax Year

CouNTY

dISTRICT

mAp

pARCel

Sub-pARCel

pp ACCouNT

# of People in Household

Maximum Income

# of People in Household

Maximum Income

1

$17,820

3

$30,240

2

$24,030

4

$36,450

** For each additional Person, add $6,210

Part III

Are you required to file a federal return?

YES — your federal adjusted gross income reported to the IRS must meet the following guidelines for you to qualify

for this credit:

1.

Enter the Federal Adjusted Gross Income of the homeowner.....................................................................

2.

Enter the income of all individuals listed as living in the household....................,,,,,,,,................................

3.

Add lines 1 & 2 and enter result here. If this amount is more than the maximum income listed in the

table above, you do not qualify for the credit..............................................................................................

NO — your income less social security benefits must meet the following guidelines for you to qualify for this credit:

1. Wages, salaries, tips received.....................................................................................................................

2.

Interest and dividend income......................................................................................................................

3.

Alimony received........................................................................................................................................

4.

Taxable pensions and annuities..................................................................................................................

5. Unemployment compensation.....................................................................................................................

6. Other income (include capital gains, gambling winnings, farm income, etc...............................................

7.

Add lines 1 through 6.................................................................................................................................

8.

Adjustments to income (i. e. alimony paid, IRA, etc.).................................................................................

9

Enter the income of all individuals listed as living in the household...........................................................

10. Line 7 minus line 8 plus line 9. If this amount is more than the maximum income listed in the above

table, you do not qualify for the credit.........................................................................................................

**YOU MUST FILE the enclosed forms to receive your credit for refund**

Please refer to the detailed instructions on the back…

*p40201614S*

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1