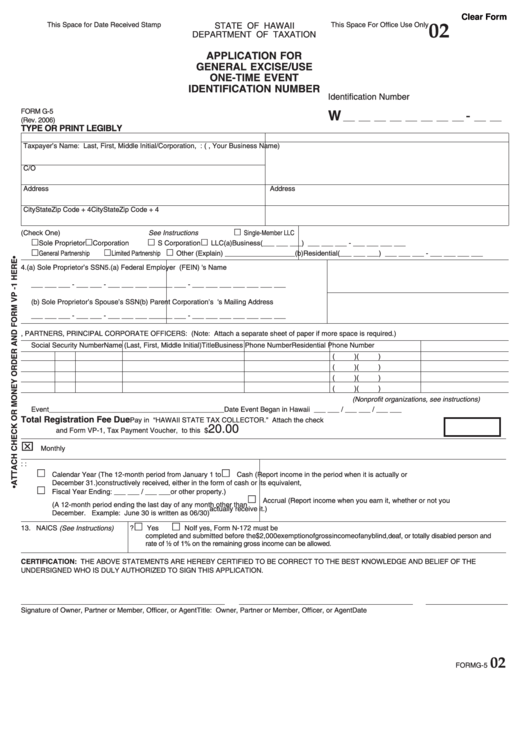

Clear Form

This Space for Date Received Stamp

STATE OF HAWAII

This Space For Office Use Only

02

DEPARTMENT OF TAXATION

APPLICATION FOR

GENERAL EXCISE/USE

ONE-TIME EVENT

IDENTIFICATION NUMBER

Identification Number

FORM G-5

W

-

___ ___ ___ ___ ___ ___ ___ ___

___ ___

(Rev. 2006)

TYPE OR PRINT LEGIBLY

1. MAILING ADDRESS

BUSINESS ADDRESS

Taxpayer’s Name: Last, First, Middle Initial/Corporation, etc.

DBA Name: (i.e., Your Business Name)

C/O

Address

Address

City

State

Zip Code + 4

City

State

Zip Code + 4

£

2. TYPE OF OWNERSHIP (Check One) See Instructions

Single-Member LLC

3. PHONE NUMBER

£

£

£

£

Sole Proprietor

Corporation

S Corporation

LLC

(a) Business

(___ ___ ___) ___ ___ ___ - ___ ___ ___ ___

£

£

£

General Partnership

Limited Partnership

Other (Explain) __________________

(b) Residential (___ ___ ___) ___ ___ ___ - ___ ___ ___ ___

4. (a) Sole Proprietor’s SSN

5. (a) Federal Employer I.D. Number (FEIN)

6. Parent Corporation's Name

___ ___ ___ - ___ ___ - ___ ___ ___ ___

___ ___ - ___ ___ ___ ___ ___ ___ ___

(b) Sole Proprietor’s Spouse’s SSN

(b) Parent Corporation’s FEIN

7. Parent Corporation's Mailing Address

___ ___ ___ - ___ ___ - ___ ___ ___ ___

___ ___ - ___ ___ ___ ___ ___ ___ ___

8. OWNERS, PARTNERS, PRINCIPAL CORPORATE OFFICERS: (Note: Attach a separate sheet of paper if more space is required.)

Social Security Number

Name (Last, First, Middle Initial)

Title

Business Phone Number

Residential Phone Number

(

)

(

)

(

)

(

)

(

)

(

)

(

)

(

)

9. APPLICATION IS HEREBY MADE FOR A GENERAL EXCISE LICENSE FOR A ONE-TIME EVENT

(Nonprofit organizations, see instructions)

Event_____________________________________________

Date Event Began in Hawaii ___ ___ / ___ ___ / ___ ___

Total Registration Fee Due

Pay in U.S. dollars on U.S. Bank to “HAWAII STATE TAX COLLECTOR.” Attach the check

20.00

and Form VP-1, Tax Payment Voucher, to this form ...................................................................................................................... $

x

10. REQUIRED FILING PERIOD FOR General Excise Tax

Monthly

11. ACCOUNTING PERIOD:

12. ACCOUNTING METHODS:

£

£

Calendar Year (The 12-month period from January 1 to

Cash (Report income in the period when it is actually or

December 31.)

constructively received, either in the form of cash or its equivalent,

£

Fiscal Year Ending: ___ ___ / ___ ___

or other property.)

£

Accrual (Report income when you earn it, whether or not you

(A 12-month period ending the last day of any month other than

actually receive it.)

December. Example: June 30 is written as 06/30)

£

£

13. NAICS (See Instructions)

14. DO YOU QUALIFY FOR A DISABILITY EXEMPTION?

Yes

No

If yes, Form N-172 must be

completed and submitted before the $2,000 exemption of gross income of any blind, deaf, or totally disabled person and

rate of ½ of 1% on the remaining gross income can be allowed.

CERTIFICATION: THE ABOVE STATEMENTS ARE HEREBY CERTIFIED TO BE CORRECT TO THE BEST KNOWLEDGE AND BELIEF OF THE

UNDERSIGNED WHO IS DULY AUTHORIZED TO SIGN THIS APPLICATION.

Signature of Owner, Partner or Member, Officer, or Agent

Title: Owner, Partner or Member, Officer, or Agent

Date

02

FORM G-5

1

1