Form 2-591-1988 Notice - Important Information Regarding Your Homestead Exemption

ADVERTISEMENT

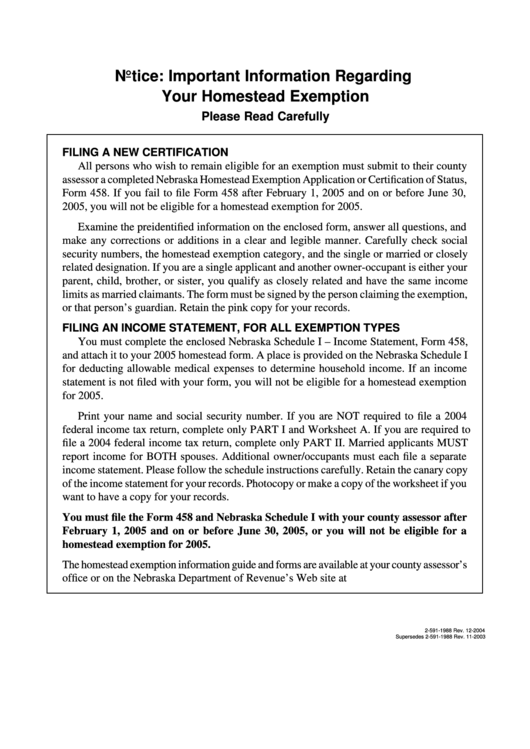

Notice: Important Information Regarding

Your Homestead Exemption

Please Read Carefully

FILING A NEW CERTIFICATION

All persons who wish to remain eligible for an exemption must submit to their county

assessor a completed Nebraska Homestead Exemption Application or Certification of Status,

Form 458. If you fail to file Form 458 after February 1, 2005 and on or before June 30,

2005, you will not be eligible for a homestead exemption for 2005.

Examine the preidentified information on the enclosed form, answer all questions, and

make any corrections or additions in a clear and legible manner. Carefully check social

security numbers, the homestead exemption category, and the single or married or closely

related designation. If you are a single applicant and another owner-occupant is either your

parent, child, brother, or sister, you qualify as closely related and have the same income

limits as married claimants. The form must be signed by the person claiming the exemption,

or that person’s guardian. Retain the pink copy for your records.

FILING AN INCOME STATEMENT, FOR ALL EXEMPTION TYPES

You must complete the enclosed Nebraska Schedule I – Income Statement, Form 458,

and attach it to your 2005 homestead form. A place is provided on the Nebraska Schedule I

for deducting allowable medical expenses to determine household income. If an income

statement is not filed with your form, you will not be eligible for a homestead exemption

for 2005.

Print your name and social security number. If you are NOT required to file a 2004

federal income tax return, complete only PART I and Worksheet A. If you are required to

file a 2004 federal income tax return, complete only PART II. Married applicants MUST

report income for BOTH spouses. Additional owner/occupants must each file a separate

income statement. Please follow the schedule instructions carefully. Retain the canary copy

of the income statement for your records. Photocopy or make a copy of the worksheet if you

want to have a copy for your records.

You must file the Form 458 and Nebraska Schedule I with your county assessor after

February 1, 2005 and on or before June 30, 2005, or you will not be eligible for a

homestead exemption for 2005.

The homestead exemption information guide and forms are available at your county assessor’s

office or on the Nebraska Department of Revenue’s Web site at

2-591-1988 Rev. 12-2004

Supersedes 2-591-1988 Rev. 11-2003

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1