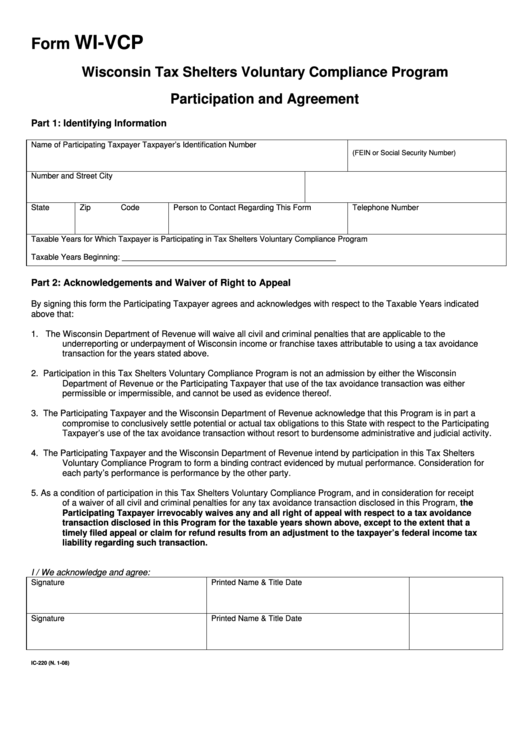

Form Wi-Vcp - Wisconsin Tax Shelters Voluntary Compliance Program Participation And Agreement

ADVERTISEMENT

WI-VCP

Form

Wisconsin Tax Shelters Voluntary Compliance Program

Participation and Agreement

Part 1: Identifying Information

Name of Participating Taxpayer

Taxpayer’s Identification Number

(FEIN or Social Security Number)

Number and Street

City

State

Zip Code

Person to Contact Regarding This Form

Telephone Number

Taxable Years for Which Taxpayer is Participating in Tax Shelters Voluntary Compliance Program

Taxable Years Beginning: _________________________________________________

Part 2: Acknowledgements and Waiver of Right to Appeal

By signing this form the Participating Taxpayer agrees and acknowledges with respect to the Taxable Years indicated

above that:

1.

The Wisconsin Department of Revenue will waive all civil and criminal penalties that are applicable to the

underreporting or underpayment of Wisconsin income or franchise taxes attributable to using a tax avoidance

transaction for the years stated above.

2.

Participation in this Tax Shelters Voluntary Compliance Program is not an admission by either the Wisconsin

Department of Revenue or the Participating Taxpayer that use of the tax avoidance transaction was either

permissible or impermissible, and cannot be used as evidence thereof.

3.

The Participating Taxpayer and the Wisconsin Department of Revenue acknowledge that this Program is in part a

compromise to conclusively settle potential or actual tax obligations to this State with respect to the Participating

Taxpayer’s use of the tax avoidance transaction without resort to burdensome administrative and judicial activity.

4.

The Participating Taxpayer and the Wisconsin Department of Revenue intend by participation in this Tax Shelters

Voluntary Compliance Program to form a binding contract evidenced by mutual performance. Consideration for

each party’s performance is performance by the other party.

5.

As a condition of participation in this Tax Shelters Voluntary Compliance Program, and in consideration for receipt

of a waiver of all civil and criminal penalties for any tax avoidance transaction disclosed in this Program, the

Participating Taxpayer irrevocably waives any and all right of appeal with respect to a tax avoidance

transaction disclosed in this Program for the taxable years shown above, except to the extent that a

timely filed appeal or claim for refund results from an adjustment to the taxpayer’s federal income tax

liability regarding such transaction.

I / We acknowledge and agree:

Signature

Printed Name & Title

Date

Signature

Printed Name & Title

Date

IC-220 (N. 1-08)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1 2

2 3

3